ETF Comparison: Miller Value Partners Appreciation ETF (MVPA) v. ARK Innovation ETF (ARKK)

Diversification is a widely used portfolio allocation strategy investors to manage risk. With the current high concentrations in the S&P 500 Index, particularly in the Mag 7 and the rise in passive investing – more investors may run the risk of higher concentrations in their own portfolios. Now may be the time to consider the benefits of diversification.

Enter Active Investing. Finding strategies that have lower overlap with indexes, also known as high active share, can help investors diversify their portfolios to, in theory, improve risk and return potential.

Today, we want to look at how Miller Value Partners Appreciation ETF (ticker: MVPA) stacks up as a diversifier against one of the largest and well-known ETFs: ARK Innovation ETF (ticker: ARKK). While both funds are actively managed strategies, there are differences in the manager styles and approaches. This can help investors gain exposure to different opportunity sets not only from the S&P 500 Index, but also from each other.

First, we’ll do a quick overview of the two funds. Then we’ll look at the portfolios. Finally, we’ll look at performance. (click link to jump to a section)

Overview

Cathie Wood’s flagship ARKK fund focuses on investing in what they identify as “disruptive innovation”, defined as “the introduction of a technologically enabled new product or service that potentially changes the way the world works.”1 The fund invests in growthier areas of the market across the market cap spectrum – “growth” companies often tout the possibility of substantial increases in sales and/or earnings, and investors tend to be attracted by rapid future growth potential.

Growth names tend to have high market valuation multiples relative to their earnings, which reflects the market’s expectations that these companies will be able to continue delivering growth.

On the other side of the spectrum, we have value. Value companies tend to trade at valuation multiples, such as price-to-earnings and price-to-cash flow, below the average of the market. The opportunity in value investing happens when companies can be bought at a discount to what the investor thinks they can be worth in the future. Value investing is about understanding how a company can create value over time and what it takes for the market to realize that value and price it accordingly in the future.

This is how Miller Value Partners approaches its goal of generating market beating returns. In our MVPA ETF, we look for situations where the market has low expectations today about how a company will perform in the future. We spend a significant amount of time learning what the company has or can do that could make it more valuable – maybe assets, strategic changes, or capital allocation priorities. We look carefully at management teams to understand what their plan is for creating value and how aligned their plan and incentives are with shareholder objectives. Then we stay invested until the market catches up to our view and the stock price reflects the value we believe is fair. At that point, we may move on to the next value opportunity.

If you’re looking for a theme in MVPA, it’s alignment. This might not sound as sexy as “innovation”, but, in our opinion, it’s been one of the key drivers of returns for investors. We look closely at how aligned the management team of a company is with its shareholders. If everyone is on the same page about creating shareholder value and the incentives align too – then we believe there’s a higher probability that investors will see better returns.

MVPA’s value style of investing is different from the growth focus of ARKK, which gives investors the opportunity to diversify risk/return drivers in their portfolios. Which brings us to our next section…

Portfolios

The portfolios exhibit a few similarities:

- Both portfolios have high active share, meaning they are very different from the S&P 500 Index. MVPA’s active share is >99% whereas ARKK came in at 95% as of 9/30/24.

- Both limit their number of holdings so they can get the potential benefits from concentration in their investments. MVPA targets 20-30 names and ARKK tends to be slightly bigger at 35-50 names.

The similarities essentially end there. As of 11/30/24, the overlap in holdings between the portfolios was zero. This makes sense given the wide difference in their investment styles as explained above. It also tells us that first, there are great opportunities to diversify a portfolio across a variety of factors using these two strategies. And second, if you’re only investing in one, you may be missing a significant area of the market landscape.

Diversification by Holdings

Let’s look at the top 10 holdings for the ETFs. We’ve included holdings for the SPDR® S&P 500® ETF Trust (ticker SPY) as another reference point. SPY is a passive strategy, which is materially different in approach to active strategies like MVPA and ARKK.

MVPA isn’t invested in any of the Mag 7, which offers an important point of differentiation from passive strategies with high concentrations in these names.

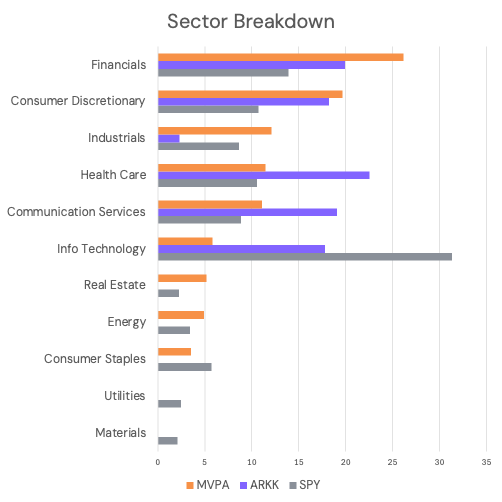

Diversification by Sectors

Discounted stocks can pop up across the market, so a benefit of MVPA’s approach is its flexibility to invest where the manager sees the best return potential. Our stock picking approach means sectors become a by-product of our process.

MVPA and ARKK may invest in different companies within the same sector, offering further diversification. SPY aims to mirror the S&P 500 Index, holding companies across all eleven GICS sectors.

Diversification by Characteristics

As of 11/30/24, MVPA fell in the mid-cap range with a median market cap of $7.4B. ARKK and SPY were in the large cap range with median market caps of $17.9B and $38.5B, respectively.

As discussed above, growth companies tend to already have higher relative valuations to reflect the higher growth expectations. On the value side, discounted valuations can create the potential for future returns if the market reprices a company’s value.

One interesting point to note, Morningstar provides a Cash Flow Growth Factor (CFGF) for each portfolio which is “a measure of how the stock’s cash flow per share (CFPS) has grown over the last three to five years.” Cash flow is an important part of how we assess value for a company in our analysis, as cash flow allows a company the ability to increase value through a variety of actions, such as stock buybacks, acquisitions, and research & development.

MVPA’s portfolio CFGF is 1.5x ARKK’s:

CASH FLOW GROWTH FACTOR

MVPA: 13.02

ARKK: 8.73

SPY: 8.93

Source: Morningstar. As of 11/30/24

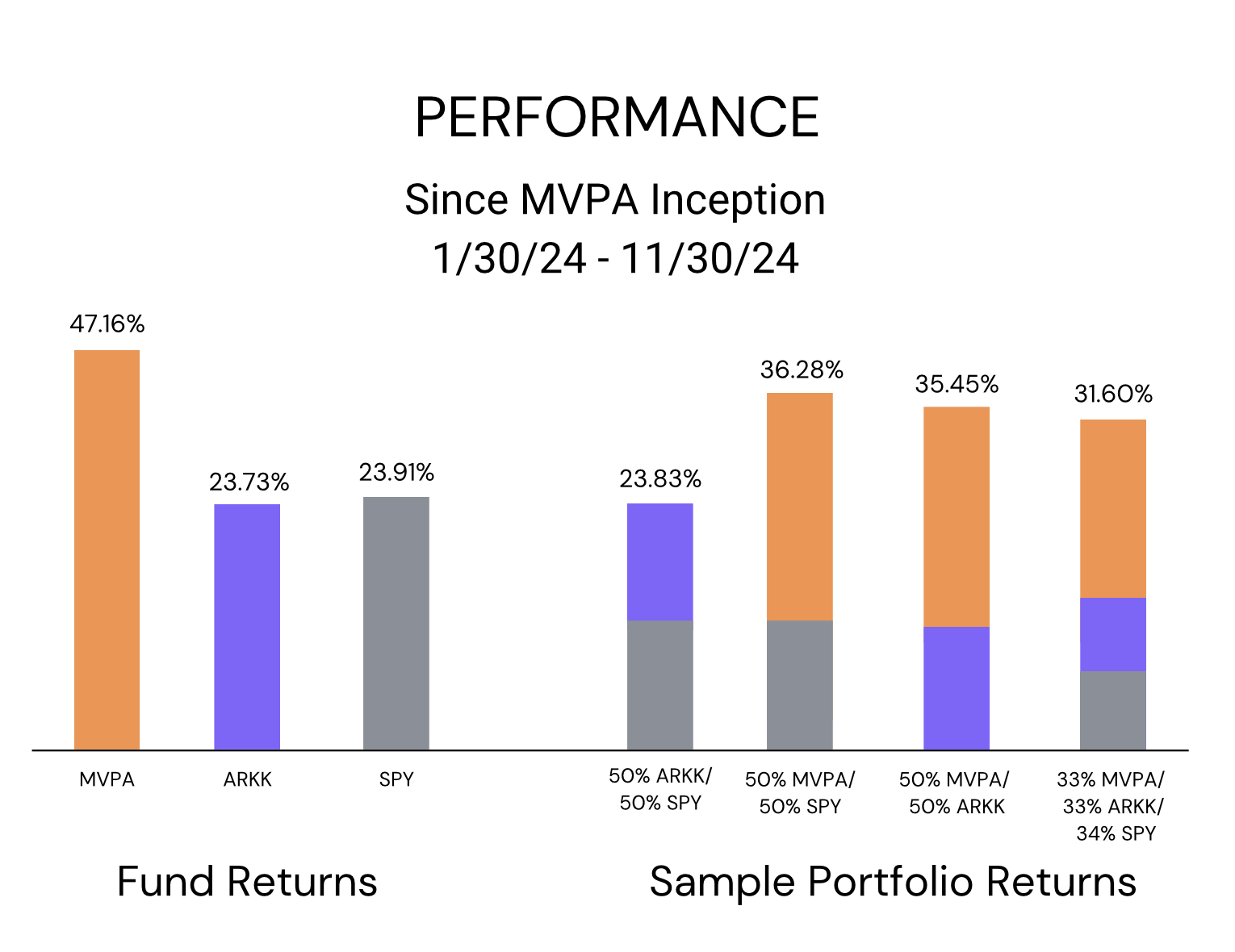

Performance

While rooted in the investing approach Miller Value Partners has employed over 25+ years, MVPA incepted and opened for public investment in January 2024 after the strategy was honed in a private internal account for more than 7 years.

Here we look at a few ways an investor could have approached investing in the strategies since MVPA’s 1/30/24 inception – in the individual funds or as a diversified portfolio – 50/50 in MVPA and SPY, 50/50 in ARKK and SPY, 50/50 in MVPA and ARKK, or 1/3 allocated to each.

It’s interesting to note the correlation data for the Funds. Since its inception through 11/30/24, MVPA has been less correlated to SPY than ARKK. MVPA has also delivered higher performance.

Source: Bloomberg.

Source: Bloomberg.This year, we’ve seen the market take interest again in stock-picking strategies. We’ve been in a market where the spreads between the most expensive and the least expensive – or valuation spreads – have been at historical extremes. When the market has broadened out in past cycles, smaller cap and value have been beneficiaries. We’ve talked about this on our quarterly calls (here’s the most recent).

As investors consider where to go from this point, meaningful diversification – through style, approach, and/or holdings – may improve the risk/return profile of a portfolio.