In the second quarter of 2023, the Miller Income Fund’s I-shares generated a 3.42% total return, outperforming the ICE BofA US High Yield Index’s 1.66% return. Equity markets continued moving higher, while bonds were lower, as evidenced by the Barclays US Aggregate index ending down -0.84%. It was another rude surprise for high quality bond investors, marking the fourth quarter of negative returns in the last six. Losing money has been the exception in bonds since the start of the US bond bull market in 1981, with four out of five quarters seeing positive returns during that span.

On a variety of occasions over the past few years, we have warned that a combination of low starting bond yields and significant interest rate risk, also known as “duration,” made some high-quality bonds especially susceptible to losses. One of the bull cases for equities has been the acronym “TINA,” which has stood for “There Is No Alternative” to investing in stocks, because bonds’ low starting yields implied that ongoing deflation would need to prevail if bondholders were to continue eking out returns; sustained deflation is not a feasible outcome in the US for a variety of reasons that we will leave for another time.

At this point, the “TINA” case for having a minimal allocation to bonds no longer holds. Capital has a cost again, with two-year Treasury notes yielding just under 5% as of this writing versus the latest annualized inflation numbers running at half that. While bonds are interesting again, the “TINA” acronym may now be valid for equity sectors other than tech, which trades at a 3% earnings yield in a year when analysts project barely over 1% growth in the group’s earnings per share. Indeed, the tech sector trades at a valuation multiple premium1 of 60% today versus the market, which is a level last seen in conjunction with the tech collapse over twenty years ago.

Of course, one should have a much stronger case to bet heavily on a collapse than “last time relative valuations were here, bad stuff happened.” Valuation and past precedent do not augur the future, or investing would be a simple exercise. None of this stops people from making all kinds of useless forecasts and predictions based upon simple correlations and limited sample sizes. For instance, Bloomberg publishes a “US Recession Probability Forecast,” which is the median forecast probability of recession over the next year taken from dozens of Wall Street pros. That number is currently 65% — a scary number, no doubt, until one considers the recent track record of the indicator. It registered a scant 25% at the end of February 2020 and soared to 100% at the end of April 2020 as COVID lockdowns brought economic activity to a halt. The National Bureau of Economic Research has since reviewed this time period and put official start and end dates on the recession, which began in February 2020 and ended in April 2020. Said differently – economic forecasters found it very unlikely that a recession was pending when it had already begun, and they predicted a 100% probability of a recession after it ended and none was forthcoming. The retort of soothsayer fans might be, “But it was COVID, it was a different kind of recession!”

Every economic and investing environment is unique. A top point of concern today is the yield curve, portions of which have been inverted for a year now. Inversions have occurred before many recessions, and the thinking goes that when long-term rates fall below shorter term rates, the short-term rates will eventually need to come down to offset a slowing economy. Understanding the applicability of reference classes is among the most critical components in generating excess returns. Perhaps the most underrated reference class is what happens most of the time – human progress continues. Monetary policy makers know more about the economic machine than ever, and they have a wider set of tools at their disposal to implement policy. Perhaps most importantly, a recession is the opposite of the Fed’s mandate. We are emerging from a unique period in economic history, so it would make sense for events without precedent to continue occurring in markets. One event might be a deeply inverted yield curve without a recession.

When people wring their hands over the shape of the yield curve and what it could mean for the economy, they are neglecting other powerful indicators. Homebuilders are breaking out and approaching all-time highs at the same time that mortgage rates are spiking to multi-decade highs. This is not because consumers are fearful; it is because they are optimistic about the future and making a massive commitment to it. Real hourly wages are again growing for the first time in over two years, which implies more purchasing power for those who need it most and are likely to spend. The VIX recently closed below lucky 13, a level not seen in over three years. The headline inflation number is at the lowest level in over two years after twelve consecutive declines. If the Fed’s tightening indeed tips us into a recession, it is a pretty easy fix to start the printing presses again.

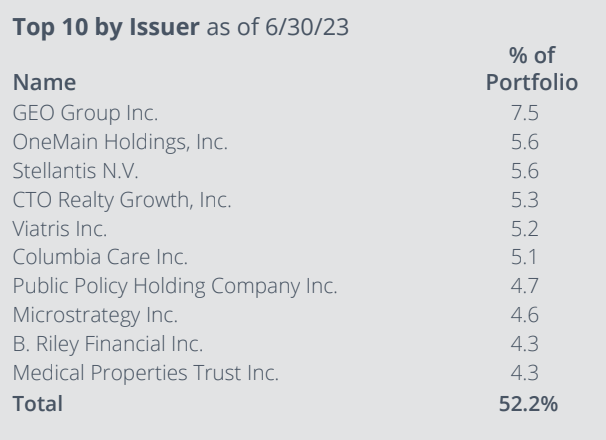

Of course, we do not make forecasts or try and predict the future in constructing the portfolio. We look to own businesses and bonds whose prices do not fully reflect their earning potential. In the past quarter, we made minimal changes to the portfolio. The most significant changes were an increase in the weight of Western Alliance (WAL), which we boosted as deposits and execution continue to suggest a fundamental disconnect between share price and value. We initiated a starter position in Stellantis (STLA), which makes Jeep, Dodge and Fiat cars. The company has a nearly 8% dividend yield with enough net cash (cash minus debt) on the balance sheet to cover the dividend for almost five years. The company trades at 1.7x operating profits, which means the market is already expecting a likely drop in cash flow. Still, the shares appear to be worth meaningfully more than where they trade, and management is heavily aligned with stockholders with a 14% stake. They share our view that the valuation is compelling, as the company plans on repurchasing ~3% of shares outstanding this year.

These are only two of many high-yielding securities whose prices we find appealing, and we are on the prowl daily. As always, we remain the largest investors in the fund, and we appreciate your support while welcoming questions and comments.

Top Contributors

- B Riley Financial, Inc (RILY) was the top contributor for the quarter. The company reported 1Q23 operating revenues of $380.5MM, +43.0% year-over-year (Y/Y), and Earnings per Share (EPS) of $0.51, compared to a 1Q22 net loss per share of -$0.43. Operating Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) for the quarter came in at $80.1MM, or a margin of 21.1%, compared to a margin of 31.6% in 1Q22. The company posted 1Q23 investment gains of $51.6MM, compared to investment losses of -$19.3MM in 1Q22. The company’s Capital Markets segment posted an operating revenue Y/Y gain of 10% driven by a significant increase in interest income from securities lending which helped to offset lower levels of investment banking and equity capital markets activity. The company repurchased $53.7MM worth of shares during the quarter, or 4.2% of the company’s market cap, and maintained its quarterly dividend of $1/share, or an annualized yield of 8.7%. As of quarter-end, B Riley had total debt of $2.51B, and net debt of $426.7MM, compared to $298.7MM as of 12/31/22.

- OneMain Holdings Inc (OMF) was another top performer during the quarter. The company reported 1Q23 Adjusted EPS of $1.46, compared to 1Q22 EPS of $2.35, below consensus of $1.65, and a net charge-offs ratio of 7.72%, +214bps Y/Y (+84bps sequentially), above consensus of 7.6%. Consumer & Insurance (C&I) capital generation for the quarter came in at $179MM, compared to $282MM in 1Q22, while managed receivables rose 5.8% Y/Y (-0.5% sequentially) to $20.6B with a loan portfolio yield of 22.3%. Personal loan originations totaled $2.8B in 1Q23, down 5% from $3.0B in 1Q22. The company maintained a quarterly dividend of $1/share, or an annualized yield of ~9.2%, and repurchased 683K shares for $27MM (0.5% of market cap) during the quarter. As of quarter-end, the company’s net leverage ratio stood at 5.4x, compared to 5.5x at the end of 4Q22. Management indicated that post-tightening originations now represent 38% of the company’s receivables (vs. 27% in 4Q22) and are expected to represent 65-70% of receivables by YE23.

- Medical Properties Trust Inc (MPW) gained after it reported 1Q23 revenues of $350.2MM, -14.5% Y/Y, below consensus of $352.5MM, and Normalized Funds from Operations (FFO)/share of $0.37, -21.3% Y/Y, slightly below consensus of $0.38. The company’s CEO noted “The terms of recently announced transactions including Springstone, the acquisition by CommonSpirit of Steward’s Utah operations, Healthscope, and Prime, have valued our hospital investments near and in excess of our original purchase prices. This confirmation of our underwritten asset values by sophisticated market participants, as well as our existing liquidity and prudently planned debt structure, position us to have no debt maturities until 2025.” The REIT saw a modest uptick in leverage during the quarter, with the company’s Adjusted Net Debt to Annualized Earnings Before Interest, Taxes, Depreciation, and Amortization for Real Estate (EBITDAre) ratio standing at 6.5x as of quarter-end, compared to 6.4x as of 12/31/22. Management maintained its quarterly dividend of $0.29/ share, or a 12.5% annualized yield. Management updated full-year 2023 (FY23) guidance for Normalized FFO/share of $1.56 (vs. prior guidance for $1.58), implying a P/FFO multiple of 5.9x, to account for the impact of announced deleveraging asset sales (and expected $1.4B in debt reduction).

Top Detractors

- Jackson Financial Inc (JXN) was the top detractor for the quarter. The company reported 1Q23 Adjusted Operating EPS of $3.15, -24.8% Y/Y, below consensus of $3.85. Jackson generated net investment income of $722MM, +4.6% Y/Y, while total net losses on derivatives and investments came in at -$3.4B in the quarter, compared to -$538MM in 1Q22. The company’s total annuity account value decreased -10% Y/Y (+4% sequentially) to $219B as of quarter-end, driven primarily by lower equity markets over the 12-month period. As of quarter-end, the company’s estimated Risk-Based Capital (RBC) ratio was within the company’s target range of 425-500%. Liquidity remains strong for Jackson, as cash and highly liquid securities stood in excess of $1.5B as of quarter-end, significantly above management’s targeted minimum liquidity buffer of 2x annual holding company expenses (currently $250MM). During the quarter, the company returned $124MM to shareholders via $70MM of share repurchases and $54MM in dividends, as the company remains on pace to achieve its 2023 capital return target of $450-550MM, or 19.8% of the company’s market cap at the midpoint.

- Vale SA (VALE) fell during the quarter with iron ore prices. The company reported 1Q23 revenue of $8.44B, -22.7% Y/Y, below consensus of $8.79B, and Adjusted EBITDA of $3.69B, compared to 1Q22 EBITDA of $6.55B, below consensus of $4.49B. The Brazilian miner produced 66.8 million tons (Mt) of iron ore in 1Q23, +5.8% Y/Y, below consensus of 67.7 Mt, 67.0 thousand tons (kt) of copper, +18.4% Y/Y, and 41.0 kt of nickel, -10.5% Y/Y. Although management reaffirmed its FY23 production guidance, analysts seemed to be concerned by the negatively offsetting impacts of weaker iron ore prices as China, the world’s largest iron ore buyer, has threatened to curb any “unreasonable” price gains for the metal in an effort to prevent this year’s steel output from exceeding 2022 levels. Vale generated 1Q23 free cash flow (FCF) of $2.28B, bringing trailing-twelve month (TTM) FCF to $6.73B, or a FCF yield of 11.3%. The company repurchased $763MM worth of shares in the quarter and paid $1.80B in dividends, bringing total capital returned to shareholders in the quarter to $2.56B, or 4.3% of the company’s market cap.

- Organon & Co (OGN) dropped in the quarter after it reported 1Q23 revenues of $1.54B, -1.9% Y/Y, in-line with consensus, and Adjusted EPS from continuing operations of $1.08, compared to 1Q22 EPS of $1.65, -7% below consensus of $1.16. Adjusted EBITDA for the quarter came in at $518MM, or a margin of 33.7%, -761bps Y/Y. The company’s Biosimilars segment posted revenue growth of 18% Y/Y, with the strong performance driven by Renflexis, which grew 34% Y/Y excluding the impact of foreign currency (ex-FX) due to continue demand growth in the US and Canada, as well as Brenzys, which posted Y/Y growth of 36% ex-FX as a result of timing of tenders in Brazil. The company maintained its quarterly dividend of $0.28, or a 5.4% annualized yield, and also voluntarily paid down $250MM of debt in the quarter, bringing total debt to $8.7B as of quarter-end. Management reiterated FY23 guidance for revenue of $6.30B (+2.0% Y/Y), Adjusted gross margin in the low-mid 60% range, and an Adjusted EBITDA margin of 32.0%, at the respective midpoints.