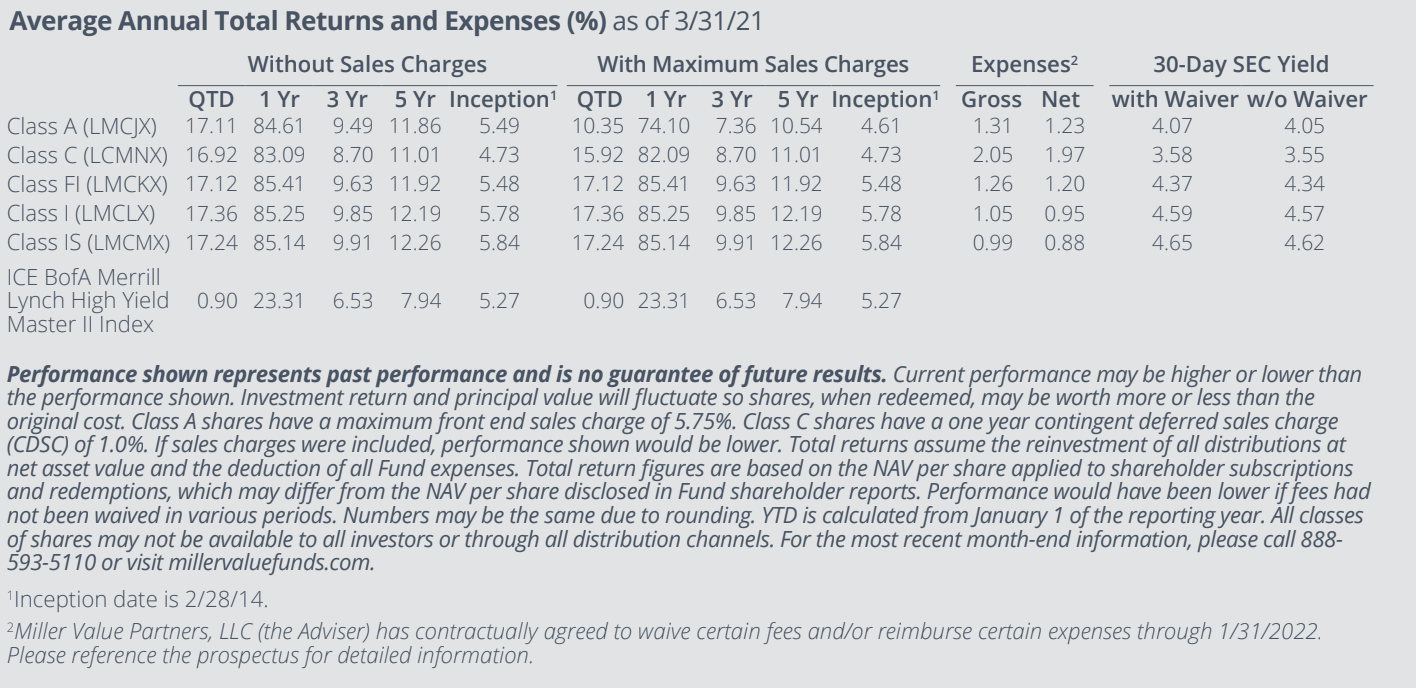

In the first quarter of 2021, the Miller Income Fund’s I-shares returned 17.36% versus 0.90% for the ICE BofA US High Yield Index. The ongoing recovery from the sharpest economic drop in the trailing century helped fuel our performance, while many income-producing assets typically considered “safe” did not fare as well and still do not appear compelling. This idea is worth reiterating in the context of the current macroeconomic backdrop, as we believe the argument for alternative, actively managed income remains strong.

There have been many extremes in markets lately, but one of the first quarter’s most noteworthy outliers was the performance of long-dated US government bonds. According to S&P, thirty-year US treasury bonds futures lost 9.85% in the first quarter, marking the asset’s worst calendar-quarter performance in over forty years. This is a rough tumble for something that most investors buy for its low volatility, when you consider that often endowment portfolio architects expect, on average, a mid-single-digit return with high-single-digit volatility. Put differently, the first 90 days of 2021 were worse for long-dated bonds than most would expect over the course of 97.5% of the years, if you are a quantitatively inclined, mean-variance portfolio theorist. The only other calendar quarter on record that was worse than the current one was Q3 of 1980, which happened to be within spitting distance of another extreme — the peak in long rates which occurred a year later. Unique levels of volatility and extremes often appear in unison, and the violent moves of late may be suggesting that we have seen the bottom in long rates.

The outlook for long-dated bonds still does not appear compelling either. The Federal Open Market Committee, which sets monetary policy, changed its process last year to account for the fact that “the level of the federal funds rate consistent with maximum employment and price stability over the longer run has declined relative to its historical average.” In other words, rates are going to stay lower for even longer.

Careful readers of Federal Reserve communications statements will also note another important but often overlooked change to the policy — namely, the Fed’s emphasis on the full employment mandate supersedes the price stability mandate. The Committee conveyed this by reversing the order of the discussion in the January 2021 policy statement and by specifically calling out this change on the website. The current headline unemployment rate of 6.0% does not tell the whole story. Committee members are quick to flag that the U-6 rate, which attempts to capture part-time and underemployed workers, shows a still-elevated rate of 10.7%, almost 60% above readings observed at the beginning of 2020.

While the outlook for “safe” US government bonds is better today than it was six months ago, that’s not saying much. After a year of limited consumption, the world has significant pent-up demand now being met with record fiscal and monetary stimulus. Still, as of this writing, ten-year US government bonds are priced to return 1.6% per year, while the Federal Open Market Committee wants prices to rise by at least 2% each year. Buyers of ten-year US government bonds likely face two choices: 1) lose purchasing power slowly (if they hold to maturity), or 2) lose it quickly (if nominal rates rise to the point where US government bonds appear able to generate a positive real rate of return). Maybe today’s buyers of US government bonds are betting that inflation cannot get to 2%. However, a simple hypothetical example would seem to demonstrate that “fighting the Fed” is not a great idea. Imagine if policymakers injected $1 million into each adult’s bank account tonight. By tomorrow, the prices of desirable goods and experiences would likely be materially higher than they are today (those that are not already sold out). There are impediments to enacting this exact policy, but the example conveys the idea that printing enough money should, indeed, lead to inflation.

While some of the “safest” fixed income assets appear well-bid, our benchmark does not look compelling either. The high-yield universe now yields 4.0%. That means that if you buy a high- yield ETF and hold it for approximately five years, you would expect to earn 4% annually before inflation, defaults and fees. Markets suggest inflation is likely to average ~2.6% per year over the next five years, which would imply a 1.4% real rate of return, assuming no defaults. However, high-yield default rates have rarely been lower than 2%, which would wipe out any real return, and high-yield ETFs also have fees that approach 0.5%.

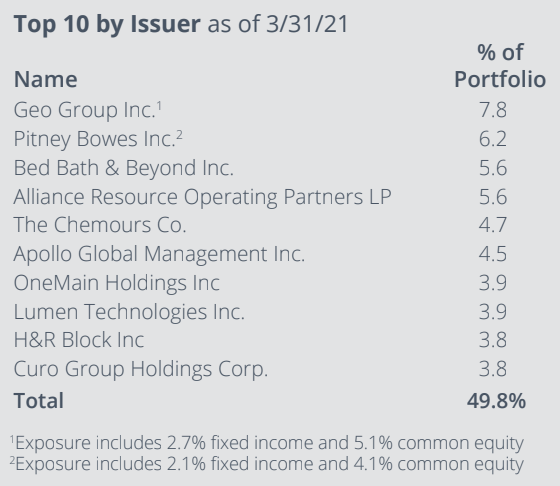

So what’s an investor looking for a little yield to do? Our concentrated portfolio offers investors a starting current yield above the yield-to-worst on the high yield index.1 We believe everything we own is undervalued, which means we hope to generate some capital appreciation on top of our current yield over a multi-year time horizon, assuming a normal, growing economy. We do this by looking for and attempting to own yield that is misunderstood or mispriced for behavioral reasons. Our own personal capital comprises a substantial portion of the Fund’s assets, so our interests align with shareholders as we eat our own cooking. As always, we remain optimistic and truly appreciate your support.

Top Contributors

- MicroStrategy 0.75% convertible bond due 2025 was the top contributor over the quarter, advancing 51.0% in sympathy with Bitcoin’s 103.3% surge and strong Q4 results in the operating business. Q4 revenue of $131M rose 3% sequentially on a 41% increase in subscription billings, while operating income of $30.1M jumped +13% Quarter-over-Quarter (Q/Q). Management introduced Fiscal Year 2021 (FY21) priorities targeting $70M-$90M of operating income, continued growth in subscription billings, and used excess capital for additional Bitcoin purchases. Over the period, the company purchased 20,856 Bitcoin, largely funded by the issuance of $1.05Bn 0% convertible bonds due 2027. MicroStrategy exited the quarter with total Bitcoin holdings of 91,326 at an aggregate purchase price of $2.2Bn, market value of $5.4Bn, and unrealized gain of $3.2Bn.

- Pitney Bowes (PBI) rose 34.5% during the period after reporting Q4 revenue of $1.03Bn and Earnings Per Share (EPS) of $0.13, both topping consensus of $938.7M and $0.10, respectively. E-commerce revenue of $500M rose +60% Year-over-Year (Y/Y) on the back of +50% volume growth while organic revenue advanced +24%. The company generated $111M in operating cash flow (+31% Y/Y) and $97M in free cash flow (+19% Y/Y), driving debt reduction of $31M. PBI exited the year with total liquidity of $1.2Bn, comprised of $940M in cash and $260M available on the Revolving Credit Facility, implying trailing twelve month (TTM) net leverage of 4.3x. For FY21, management expects low-to-mid single digit revenue growth, positive EPS growth, and slightly lower free cash flow due to working capital reversal and a normalized level of capital expenditures (capex). PBI announced a series of steps to further optimize its capital structure, extend its maturity schedule, and lower its cost of borrowing, including the redemption of the $173M 3.375% unsecured bonds due 2021 and a tender offer for up to $375M of its 2022-2024 maturities. Additionally, the company secured a new $450M Term Loan-B at L+400 bps2 due 2028, which in conjunction with a portion of the proceeds from the unsecured issuance, will retire the existing $850M Term Loan-B due 2025.

- Chico’s FAS (CHS) rose 108.2% during the quarter alongside “epicenter” stocks with the passing of the $1.9 trillion stimulus bill, as well as President Biden’s goal of ensuring vaccine availability for all US adults by May 1st and a “return to normalcy” by July 4th. Chico’s reported Q4 net sales of $386.2M, down 26.7% Y/Y (+10% Q/Q) driven by a 24.9% drop in comps and 39 permanent store closures, partially offset by +20% growth in digital sales. Soma continues to top expectations with revenue of $119.1M, comps of +15.2%, and digital growth of +68%. While management did not provide formal 2021 guidance, they expect consolidated sales trend improvements in the second half of 2021 in conjunction with the vaccine rollout and significant margin improvement driven by a 30% reduction in planned inventories and second round of lease negotiations. Additionally, the company anticipates closing 13%-16% of the remaining store fleet over the next three years with the vast majority coming from mall-based Chico’s and White House Black Market.

Top Detractors

- Viatris Inc (VTRS) Viatris Inc (VTRS) was the top detractor over the quarter, falling 17.5% in the company’s first full quarter following the combination of Mylan and Pfizer’s Upjohn business. Management initiated FY21 guidance that came in below expectations, including revenue of $17.2Bn-$17.8Bn (consensus of $18.5Bn), Earnings Before Income, Taxes, Depreciation, and Amortization (EBITDA) of $6.0Bn-$6.4Bn (consensus of $7.1Bn), and Free Cash Flow of $2.0Bn-$2.3Bn ($3.5Bn-$3.8Bn excluding cash costs to achieve synergies and other one-time items). That said, the company reiterated that 2021 represents the trough year for the business given a number of one-off headwinds that are expected to decline rapidly over the next two years. Based on a 25% dividend payout ratio of free cash flow (FCF), the Board expects to approve a dividend of $540M, or $0.44/share (3.3% annualized yield) with the expectation to grow the dividend amount thereafter. Additionally, the company expects to repay $6.5Bn in debt by the end of 2023 and is targeting a long-term leverage ratio of 2.5x.

- GEO Group (GEO) declined 9.8% during the period as President Biden’s Executive Order directing the Department of Justice not to renew contracts with private prisons at the Federal level offset solid Q4 results. GEO reported Q4 revenue of $578.1M, in-line with consensus while EBITDA of $107.9M topped estimates of $87.7M by 23%. Adjusted Funds from Operations (AFFO) of $0.62/share fell 6% Y/Y and provided coverage of 2.5x on the quarterly dividend of $0.25/share (13.5% annualized yield). The company exited the quarter with ample liquidity of $420M and remains committed to paying down $75M-$100M of debt annually. Management introduced 2021 guidance with revenue of $2.24Bn-$2.27Bn, EBITDA of $386M-$400M, and AFFO of $1.98-$2.08, all of which assumes Bureau of Prison contracts with optional expiration periods in 2021 will not be renewed. Additionally, GEO announced a $200M convertible notes offering due 2026 with net proceeds funding the redemption of the 5.875% unsecured notes due 2022.

- Lumen Technologies 7.6% unsecured bond due 2039 dropped 4.2% over the period. The company reported Q4 revenue of $5.125Bn, topping consensus of $5.1Bn driven by stronger than expected results in both international and consumer segments. EBITDA of $2.28Bn (44.5% margin) beat street estimates of $2.20Bn by 3.25% on continued acceleration of the cost transformation plan, achieving $830M of run-rate savings a year ahead of schedule. FCF of $1.0Bn drove $755M of sequential debt paydown with FY20 debt reduction reaching $2.8Bn. Lumen exited the year with gross debt of $31.8Bn and cash of $406M, implying TTM net leverage of 3.5x. Management provided FY21 guidance, including EBITDA of $8.4-$8.6Bn, FCF of $2.8Bn-$3.0Bn, and capex of $3.5Bn-$3.8Bn.