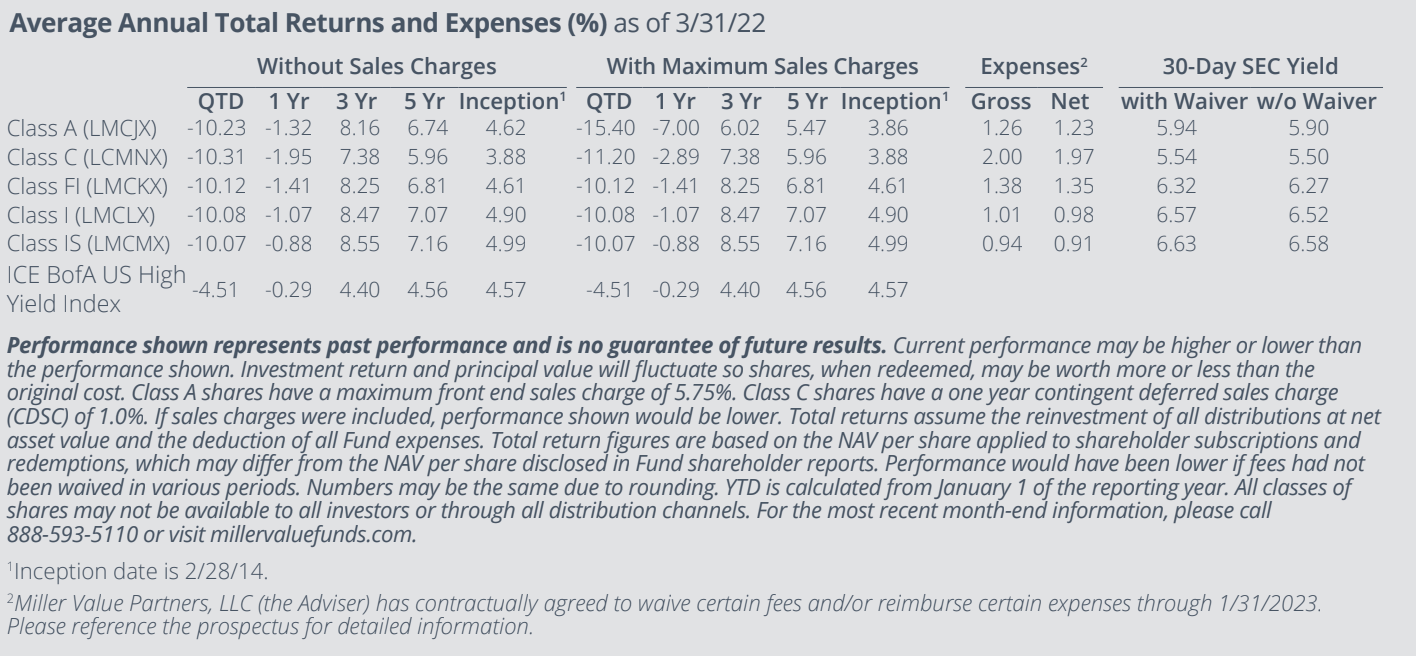

The Miller Income Fund (Class I) returned -10.08% for the first quarter, while the unmanaged high-yield benchmark was down -4.51%. Most asset classes declined, and smaller companies, which make up a large share of the Income Fund, generally fared the worst. This is apparent in the Russell 2000’s -7.5% drop against the larger-cap Russell 1000’s -5.1% decline. The Fund’s performance in Q1 was not atypical, as our worst relative quarters have historically occurred in conjunction with broader pullbacks. This is because we approach the world and security valuations from a probabilistic perspective of optimism, as the economy tends to grow most of the time, and trying to predict upcoming recessions has historically been a fool’s errand, regardless of the indicator or judgement used. The economists at the National Bureau of Economic Research who maintain a chronology of business cycles only do so with the aid of many months of hindsight.

Still, the best starting point for understanding what is likely to happen in the real economy is the market itself, as markets discount the future with the power of collective wisdom. As of the middle of April, the market is telling us the economy is still strong, though the rate of growth is now slowing due to overheating and inflation. While the Federal Open Market Committee is meeting its maximum employment goal, it is falling further behind on its price stability goal. The oft-mentioned supply-chain constraints are preventing a fully employed and flush consumer from getting what he wants, causing a rapid spike in the price of almost everything from labor to capital, compressing profit margins in the process. Marginal returns on capital are rising much faster for capital-intensive industries than they are for service-based capital-light industries, which partially explains why so-called “value” securities have been outperforming “growth.” With unemployment claims running at an all-time low, the quickest way to fill a job is to pay more, helping push inflation to a forty-year high.

Red-hot inflation now looks like it is weighing on growth. Over the course of 15 months, the 30-year fixed mortgage rate has gone from just below 3%, or the lowest level on record, to just over 5%, which is a level we have not seen in over a decade. The market is telling us that the spike in annual cash outlays for the homebuyer may coincide with an imminent slowdown in the real estate market, as the homebuilders ETF is off 28% year-to-date. However, with the most recent Case-Shiller numbers showing that home prices grew at an all-time high rate of 18.6% in 2021, only paying 5% to own that asset seems like such a no-brainer that one can only wonder how the situation resolves itself.

All of these extremes in the housing, capital and labor markets are causing some to predict a recession, which the National Bureau of Economic Research defines as “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.” The Atlanta Fed estimates that real GDP grew at 1.1% in the first quarter of this year, which is a slower rate of growth than we saw emerging from lockdowns, but it still represents growth. While the 2-to-10-year yield curve inverted for a day or two, it has since surged back into positive territory on a spike in rates at the long end of the curve, and more reliable yield curve indicators continue to suggest continued economic growth ahead. Market-derived inflation expectations also show no sign of rolling over.

So, how are we changing the portfolio to account for these extremes? We are continuing to look for and own yield- generating securities whose valuations are likely too low for a range of economic conditions. We have been selling debt that yields less than inflation as well as names that may not fare well in a volatile interest rate environment. There are many attractively priced securities with yield, and we are on the prowl. In the past, the Fund has done well in emergences from pullbacks, and we hope the balance of this year will be no different. As the largest shareholders of the Fund, we appreciate the support and welcome any questions or comments.

Top Contributors

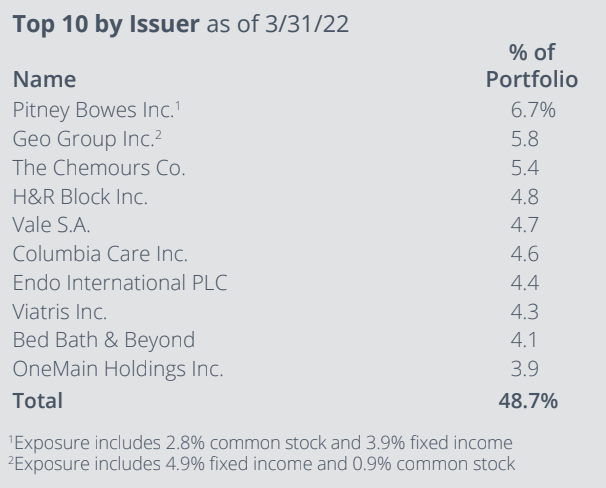

- Vale SA (VALE) was the top contributor for the quarter, gaining 48.1%. Vale reported full-year 2021 (FY21) revenues of $54.5 billion, up 37.8% year over year (Y/Y), and adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $31.2 billion, up 87.8% Y/Y. Vale paid out $13.5 billion in dividends and repurchased $5.5 billion in common stock, representing $19.0 billion in capital returned to shareholders in 2021, or ~20.1% of the company’s market cap. The company’s base metals segment improved in 4Q21, with nickel production increasing 59% from 3Q21 to 48.0 thousand tonnes (kt) and copper production increasing 12% from 3Q21 to 77.5 kt. Increased electric vehicle (EV) production is expected to serve as a significant tailwind for this segment, as both metals are integral components of the EV battery manufacturing process, with management citing an expected compound annual growth rate from 2019-2031 of 29.9% and 20.6% in EV-driven demand for nickel and copper, respectively.

- Quad Graphics (QUAD) rose 73.5% over the period. Quad reported FY21 sales of $3.0 billion and adjusted EBITDA of $246.0 million, while reducing net debt to $624 million as of 12/31/21. The company has reduced total net debt by $410 million since the beginning of 2019, or a 40% reduction. Management is guiding for FY22 sales to increase 5% and adjusted EBITDA of $250 million, at the midpoint of both guided ranges, while also targeting a year-end debt leverage ratio of ~2.25x, compared to ~2.54x as of year-end 2021, implying an additional $60+ million reduction in net debt. Quad continues to execute on its revenue diversification strategy into higher margin services, with the company’s integrated solutions and targeted print segments increasing to 64% of net sales in 2021, compared to 58% of net sales in 2019.

- H&R Block (HRB) advanced 11.8% during the quarter. H&R Block reported 2Q22 revenue of $158.8 million, +11.9% Y/Y, and ahead of consensus of $152.8 million, and an adjusted quarterly loss of $1.02 per share, compared to consensus expectations for a loss of $1.24 per share. The company repurchased $159 million of shares in Q2, bringing the first half of the fiscal year’s total share repurchases to $325 million, representing ~7.3% of the company’s market cap, while also declaring a quarterly dividend of $0.27/share, implying an annualized yield of 4.0%. The company benefited from Emerald Card revenues increasing $14.9 million during the quarter, or 149.2% Y/Y, and has positioned itself for a strong second half of the fiscal year with the launch of its new mobile banking platform, Spruce, alongside the imminent tax season.

Top Detractors

- Sberbank (SBER LI) and Alrosa (ALRS RX) were the top detractors for the quarter, with each falling 99.9%. We have marked these securities at a price of 0 to reflect the uncertainty regarding our ability to transact in these securities going forward.

- Stronghold Digital Mining (SDIG) fell 54.5% during the quarter as the bitcoin miner reported below-consensus 4Q21 revenue of $17.0 million and a loss of $0.52 per share. Additionally, Stronghold issued a warning that headwinds related to miner receipts, deployments, and performance have led them to revise their initial year-end (YE) 2022 target hash rate capacity of 8.0 exahash per second (EH/s) to 4.3 EH/s, compared to YE 2021 capacity of 1.3 EH/s and late-March 2022 capacity of 2.3 EH/s. While management reduced processing power guidance, they noted that current guidance would likely not require additional capital.

- Endo International PLC 6.0 6/28 declined 22.1% during the period. Endo reported 4Q21 revenue of $789.4 million, +3.8% Y/Y, and ahead of consensus of $731.4 million. Adjusted EBITDA of $386.5 million, was up 9.9% Y/Y. Endo reported a loss from continuing operations of $556.7 million, compared to reported income from continuing operations of $141.2 million in 4Q20, primarily as a result of asset impairment charges and opioid settlement and litigation-related costs, which collectively amounted to $590.8 million in the period. The company’s generic pharmaceuticals segment generated 4Q revenues of $218 million, +21% Y/Y, as the segment benefited from new product launches, including the first authorized generic for IBS treatment, Amitiza. In the beginning of March, a Tennessee judge found the company liable in an opioid-marketing case by default, stripping the company of its legal defenses. Endo is now reportedly set to face a trial in 2023 that will determine the amount payable to settle charges, with analyst estimates for the company’s total liability for all cases, pegged at slightly over $1 billion.