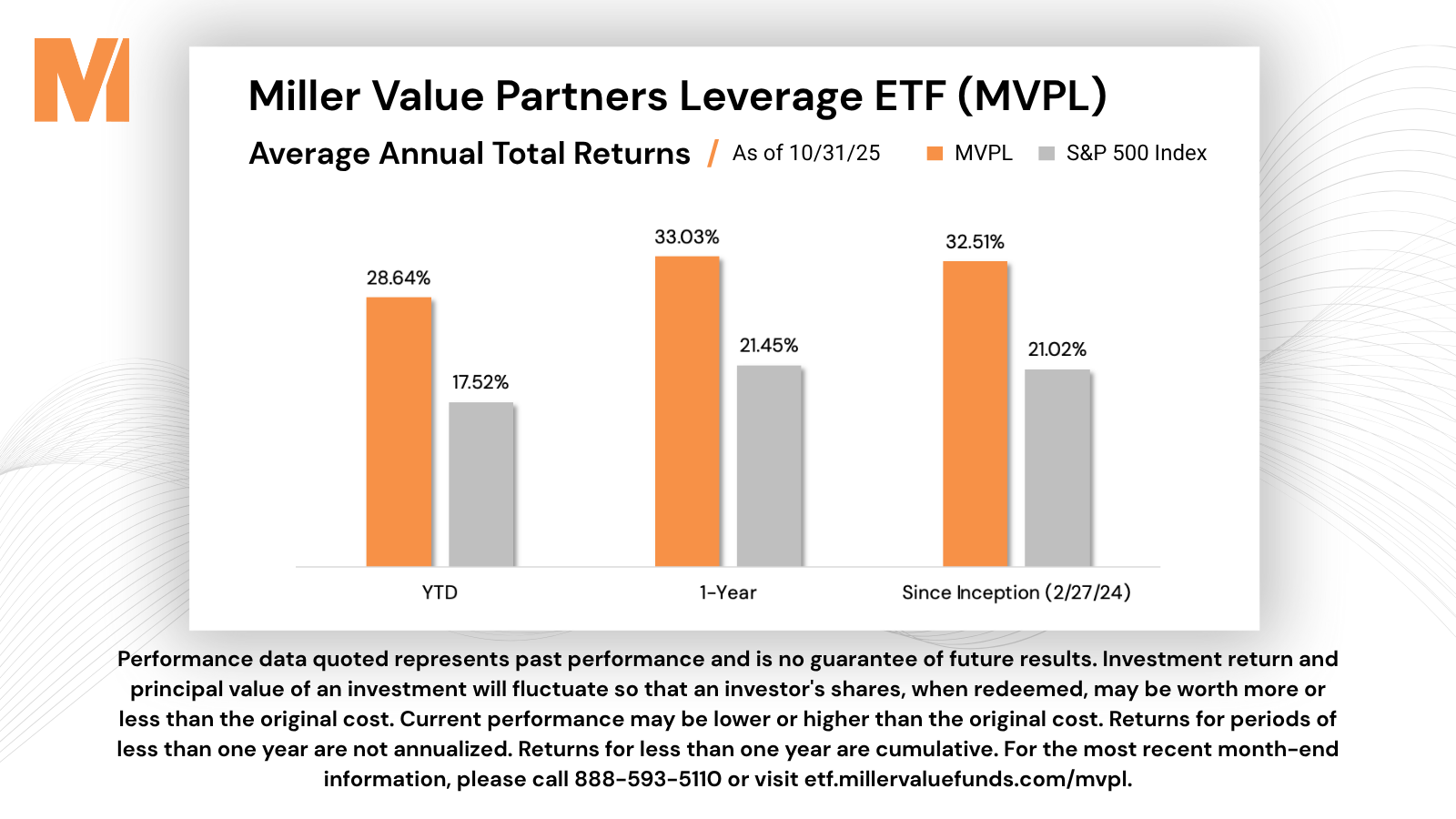

As the systematic Miller Value Partners Leverage ETF (MVPL) has generated a compelling 32% annualized rate of return in its first 20 months since launch, we thought a Q&A with strategy architect Bill 4 would help investors learn more about the process behind it and his thoughts on how it might do in down markets and over longer time horizons.

Miller Value Partners is known for its focus on value strategies. MVPL seems like a departure. What was the genesis of the idea?

This is effectively MVP’s most direct response to the ongoing surge in passive index investing — we appreciate the power and knowledge owing to the wisdom of crowds while being unsatisfied with the returns associated with passive index investing.

There are two ways to outperform the market — you can try and find the stocks that you think are likely to do well and own more of them than the index does (MVPA), or you can own the entire index and vary your exposure to it (MVPL).

No approach will work all the time — the best stockpickers go through prolonged periods of underperformance, and any approach that borrows money to generate performance is subject to sudden large downdrafts. However, owning the entire index mitigates one of the biggest risks faced by concentrated stockpickers: namely, the possibility that an unowned stock or group of stocks outperforms. The basic premise behind MVPL is pretty simple: you want to be levered long assets that tend to appreciate over long periods of time.

While borrowing money to own the entire index seems antithetical to a stockpickers’ approach, one of the things I’ve learned from watching a master at work is that the goal of investing is to make money; the goal is *not* to be dogmatic about process at the expense of new return-generating ideas from flourishing.

Leverage seems risky, but you’re managing the leverage? How does this work? Why not just leverage on all the time if you believe the market will go up over the long term?

Our work suggests that some environments expose the leveraged investor to above-average “risk of ruin,” which we want to avoid. One of the earlier iterations of the strategy, which we tried approximately a decade ago, actively went short when the model suggested doing so; unfortunately, it didn’t work. Rather than give up on the idea, we realized that a better approach was to borrow money most of the time. We continued refining and backtesting various iterations over the following years until we were satisfied that the underlying idea was not only sound but something we could implement in an ETF format. Since we launched MVPL, we have been in a levered position almost 90% of the time, which is consistent with how we ran the strategy internally for years prior to launch.

I’ve heard that levered ETFs are only for short-term trading; should I look to trade MVPL?

No — we designed this strategy specifically for investors looking for extra juice over the long term in a tax-efficient ETF wrapper. Our work designing and running the strategy so far suggests there’s a reasonable possibility that we can achieve above-market returns using leverage over longer time horizons, albeit with volatility.

An important tenet of the strategy is that the market tends to go up over longer time horizons, though shorter time horizons are anyone’s guess. Take the third quarter for instance — the market was up 36 days, or only ~56% of the time. However, if you extend your time horizon, investing in the market over longer periods has a much better track record. Going back almost 100 years, the S&P 500 and its predecessors have risen in 69% of all 1-year periods, roughly 79% of 3-year periods, 80% of 5-year periods, and more than 88% of 10-year periods. Over any rolling 20-year+ horizon, US equities have produced positive total returns 97% of the time.1

How do you implement the strategy?

Each day, we look at market data for our signal; if the signal suggests the environment is not a good one for leveraged investing, we own the S&P 500 outright (leverage “off”). If the signal suggests that we are in the clear for borrowing money, we own a levered ETF (leverage “on”). When the signal switches, we look to use tax-efficient in-kind trading techniques to minimize taxes.

Why does the fee look high?

MVPL’s fee contains 2 parts – our 88bps management fee along with another ~51 basis points of Acquired Fund Fees and Expenses (“AFFE”), which are the costs tied to owning the underlying ETFs; the acquired fund fees shift according to how long we hold each of the underlying investment vehicles, so the headline number will vary slightly over time.

How would you expect this strategy to do in a sideways or down market?

Our development research, which clearly comes with no shortage of caveats, leads us to expect that in an extended period of negative market returns, the risk is that MVPL will experience steeper drawdowns than an unlevered market basket. However, by the same token, we expect MVPL may have the potential to return to previous highs at approximately the same time as the market.

If we enter an extended bear market, we expect the strategy will have a period of underperformance. A strong bull market for the S&P 500 has unequivocally provided a big performance tailwind for this levered S&P strategy; investors might want to consider diversifying with one of our value-centric strategies if they believe the market is collectively looking “toppy2,” though we would note the old Peter Lynch refrain, “Far more money has been lost by investors preparing for corrections than in the corrections themselves.”

I’ve heard you say you and and your father, Bill Miller III, are the largest investors in the strategy – how do you think about sizing this in your own portfolio? What role does MVPL serve in your portfolio?

One of the many things I’ve learned from B3 is to let things that are working keep working. He once said that cutting back your big positions because “they are too big in the portfolio” is like taking Michael Jordan out in the fourth quarter because he’s “too important to the outcome.” Today, I have more money in MVPL than in any other strategy; this is more a function of how well it’s done than anything else. We incubated the strategy for years prior to public launch, so it made money for me then, it’s also outperformed the market since the ETF launch, and I think the process is likely to continue working even though I expect drawdowns well in excess of the market’s drawdowns in the years ahead. For me, the strategy falls into my “max risk” bucket, and I’m very well aware that it will very likely underperform the market and other risk assets in a “risk-off” scenario, but I think over the long term, it’s more likely than not to grow my purchasing power at an above-market rate. Clearly, not everyone can lever up the market, or the system doesn’t work. The good news: we aren’t “everyone,” neither are you, and most people won’t try. Remember – “no risk it, no biscuit!”

View the current portfolio here

MVPL is available for purchase at Fidelity, Schwab, Interactive Brokers, E*Trade, Robinhood, Public.com, Ally Invest, SoFi, Webull, Apex Clearing, Pershing, Truist (at client’s request). Don’t see an option that works for you? Contact Our Team