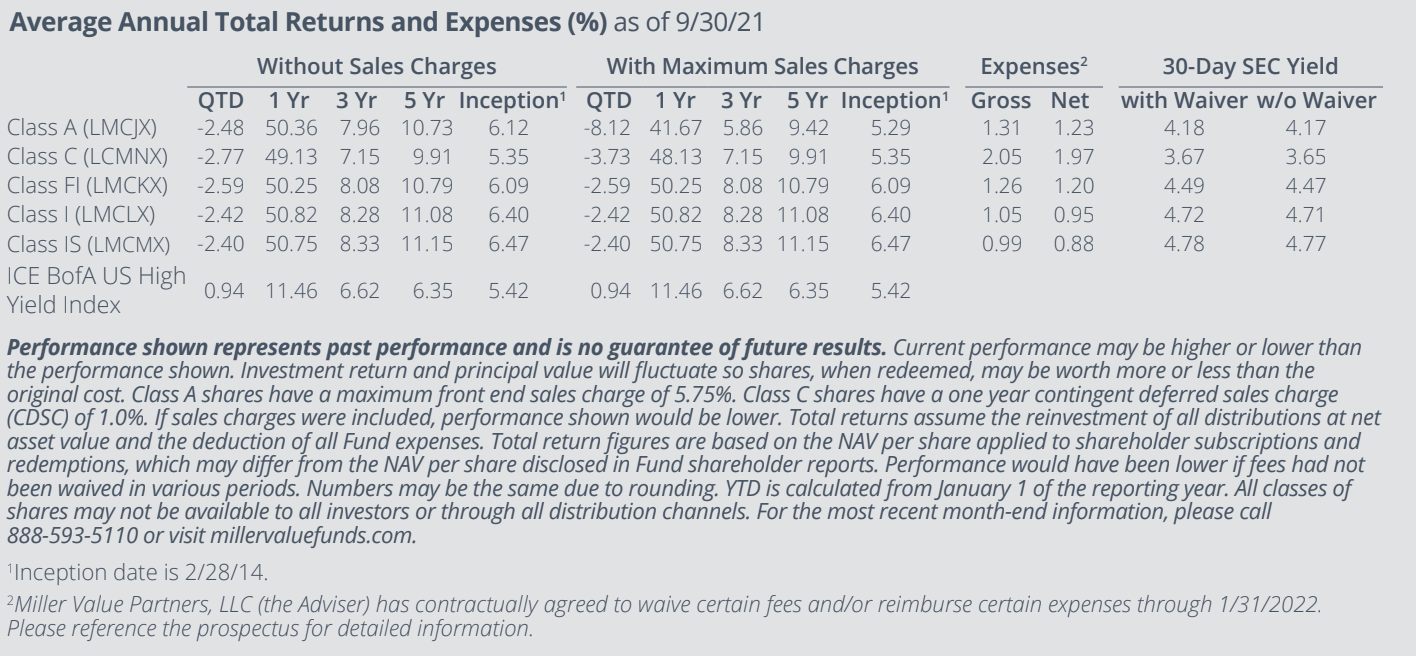

In the third quarter of 2021, the Miller Income Fund’s I-shares returned -2.42% versus 0.94% for the ICE BofA US High Yield Index. We are never satisfied, especially when we underperform, but we are not overly concerned with the third quarter given the market dynamics. Leading signals continue to suggest the economic expansion is likely to remain strong, and so we are optimistic about our positioning relative to the backdrop and relative to valuations on many securities we do not own.

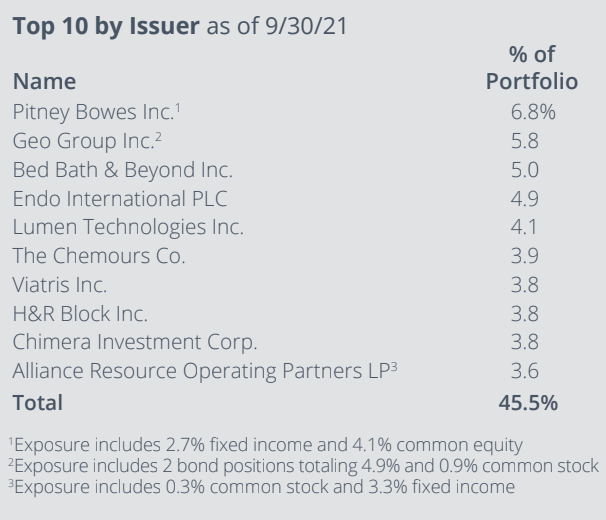

Unprecedented monetary and fiscal stimulus remain in place, creating a comfortable backdrop for sustained economic growth. This stimulus is consistent with policymakers wanting an “inclusive” recovery, which should mean more demand for labor-intensive and capital-intensive businesses. While growing demand for digital platform services primarily benefits those companies’ shareholders and employees, demand for physical goods and services creates cost pressures that benefit wages more broadly. As an example, Facebook has almost $2 million in sales per employee, while shipping and logistics provider Pitney Bowes has approximately $300,000 in sales per employee. Fewer people benefit economically from Facebook’s marginal sale than from Pitney Bowes’s marginal sale. Pitney needs to pay more staff and buy more equipment to satisfy bumps in demand, while increased Facebook usage doesn’t necessarily require more people or equipment (though the cash flow is nice for shareholders). In addition, the skills and education required to work at Facebook tend to correlate with higher levels of wealth and income than many of the positions at a logistics provider.

So, policymakers want sustained demand for capital- and labor-intensive businesses, which helps explain why the Fed is now looking for inflation to run above the “symmetric” goal of 2%. Meanwhile, the tech-heavy Nasdaq has kept up with the S&P 500 so far this year, but leadership in the index is as narrow as it was in 1999, just prior to the tech bubble bursting. Technicians associate narrow breadth with index weakness, and less than a third of stocks in the Nasdaq are above their 200-day moving average, while more than two-thirds of stocks in the S&P 500 are in that bucket.

There is little use in trying to predict when or whether the “growth vs value” dynamics will change, but it is useful to understand the causal linkages between the relative performance of those groups. Stocks tend to follow marginal returns on capital, and those increases — relative to expectations implied by valuation — are often more substantial for the “value” bucket when inflation is increasing. For instance, commodities producers shuttered some of their costlier operations last year as commodity prices plummeted, thereby reducing their invested capital base. Now, with more limited production and surging demand, prices on commodities are increasing while the invested capital base has been reduced, driving big jumps in returns on incremental capital for commodities producers. Some commodities trade close to their biggest valuation discounts against the market in recent history, which makes the group interesting, especially since commodities prices are tough to predict.

Activity in the portfolio has been subdued of late, mainly because we like what we own. We think the portfolio is chock- full of yield with compelling “upside skew,” meaning that the market will pay more for our holdings in the future than it does today. As always, we remain the largest shareholders in the fund and welcome any questions or comments.

Top Contributors

- Preferred Apartment Communities (APTS) was the top contributor over the quarter, advancing 27.3%. The company reported Q2 Funds from Operations (FFO) of $0.33, topping consensus of $0.22 on higher rental revenue and interest income as demand for Sunbelt multifamily assets drove new lease rate growth of 11%. Rental and property revenues increased 5.5% Year-over-Year (Y/Y) on a 220 basis point increase in occupancy to 96.9% while rental rates rose 1.6%. Management increased 2021 guidance, including FFO of $0.90-$1.00 (from $0.73-$0.83), same-store net operating income (NOI) growth of 5%-7% (from 2%-3%), real estate loan investment originations of $50M-$100M, and acquisition volume of $300M-$400M. Management continued to take steps to simplify its business model through the sale of $645M in office portfolio assets and using proceeds to repurchase Series-A preferred stock.

- Endo International 6.0% unsecured bond due 2028 rose 9.1% during the period. Endo reported Q2 revenue of $714M and earnings before income, taxes, depreciation and amortization (EBITDA) of $343M, topping consensus by 8% and 14%, respectively driven by strength in Branded Pharmaceuticals. Free cash flow (FCF) of $130M drove a cash balance of $1.55Bn and net debt to $6.7Bn, or Trailing Twelve Month net leverage of 5x. Endo raised the low-end of fiscal year 2021 (FY21) guidance, including revenue to $2.73Bn-$2.79Bn (from $2.65Bn-$2.79Bn) and EBITDA of $1.23Bn-$1.28Bn. Additionally, the company announced agreements in principal to settle opioid cases well below market expectations, including Tennessee for $35M, New York for $50M, and Louisiana for $7.5M. Management reiterated their primary goal of achieving a global settlement.

- Sberbank (SBER LI) rose 13.3% during the quarter. The company reported Q2 net profit of RUB 325Bn ($4.94Bn), +95% Y/Y and 11% ahead of consensus with a return on equity (ROE) of 25.8%. Net interest income rose +10% Y/Y while net fee and commission income jumped 30% driven by growth in bank card operations. Loan growth momentum continued over the period with retail +7% sequentially while net interest margin of 5.22% rose +4bps. On the back of strong first half of 2021 (1H21) results, management raised FY21 ROE guidance to over 22% (from 20% and versus consensus of 20.8%).

Top Detractors

- Vale (VALE) was the top detractor over the quarter, falling 32.6% in sympathy with iron ore’s 48% decline from record highs on China capacity curbs and growing fears of financial issues within the property sector. Vale reported Q2 EBITDA of $11.24Bn, slightly below consensus of $11.47Bn on higher than expected iron ore cash costs. Free cash flow of $6.5Bn (35% annualized yield) came in well ahead of expectations, driving $2.6Bn of stock buybacks and a 1H21 dividend of $7.6Bn, implying year-to-date (YTD) shareholder returns of roughly $13.8Bn (19% of the current market cap). Management maintained FY21 production guidance for iron ore of 315-335 Metric ton (Mt) and lowered year-end 2022 exit capacity to 370Mt (from 400Mt) due to Northern System licensing delays. Additionally, the company hosted their annual Investor Day, outlining new production initiatives aimed at becoming a key supplier to steelmakers in light of decarbonization goals.

- Chico’s FAS (CHS) declined 31.8% during the period despite reporting Q2 revenue of $472M (+54% Y/Y) and EBITDA of $50M, both well ahead of consensus of $407M and $5M, respectively. Gross margin of 38.4% reached the highest level in five years, driven by controlled inventories and lower promotional levels while FCF of $35M improved from $6.7M Y/Y and $8.9M in 2Q19. Management raised their FY21 outlook, including net sales improvement of 32%-35% (from 28%-34%) and gross margin improvement of 20%-22% (from 18%-20%), implying net sales of $1.75Bn-$1.79Bn (versus consensus of $1.75Bn) and EBITDA of $45M-$98M (versus consensus of $55M). Additionally, Chico’s announced the appointment of Patrick Guido as CFO. Mr. Guido brings over twenty years of retail experience to the management team, including as the CFO of lululemon (LULU) and Treasurer of VF Corporation (VFC).

- The Chemours Co (CC) dropped 15.9% over the period. The company reported Q2 revenue of $1.7Bn, topping consensus of $1.54Bn and rising +51% Y/Y driven by +46% volume growth while price and foreign exchange rate added +6%. EBITDA of $366M beat by 11% on increased volumes while FCF of $189M (+278% Y/Y) drove $13M of stock buybacks and $20M of debt paydown. Management expects FY21 EBITDA and earnings per share (EPS) to come in at the high-end of prior guidance, or $1.25Bn and $3.56, respectively with FCF exceeding $450M. Additionally, Chemours announced a settlement with the State of Delaware regarding all chemical cleanup and environmental remediation for the state.