Miller Value Funds Portfolio Update Q4 2024

Click these links to easily navigate to each section.

Miller Income Fund (LMCLX)

Miller Value Partners Appreciation ETF (MVPA)

Miller Value Partners Leverage ETF (MVPL)

Miller Income Fund (LMCLX)

The Miller Income Fund – Class I (ticker LMCLX) returned 7.09% in the fourth quarter, outperforming the ICE BofA Merrill Lynch High Yield Master II Index’s gain of 0.16%. Our dual objective is to deliver a high level of income with the potential for capital appreciation, and we aim to achieve this by first looking for companies where we see a dislocation in the market’s expectations and the current price. We have the flexibility to look across the capital structure and globally in pursuit of that objective. As of the end of Q4, Miller Income Fund’s current yield was 4.21% (30-Day SEC yield 6.62% and 30-Day SEC without Waiver 6.57%).

While over short periods, we may experience volatility, we are relentlessly focused on delivering outperformance over the long term. As of 12/31/24, LMCLX has outperformed its high yield benchmark for the 1, 3, 5, and 10 year periods. Additionally, Miller Income Fund was in the top 1% of 300 Funds in the Morningstar Moderately Aggressive category for the 1-year period and top quartile (21 out of 296) for the 3-year period, based on total returns.1

What drove performance for Q4? MicroStrategy (MSTR) was the top contributor in the quarter, as it rode the tailwinds of a more crypto-constructive incoming US administration and continued institutional investor adoption, which fueled Bitcoin’s surge above $100K for the first time ever. Bread Financial Holdings (BFH) was another strong performer in the quarter, benefitting from further monetary easing and an expectation for subdued late-fee headwinds. Shares still trade at less than book value despite a strengthened balance sheet, stabilizing credit quality, and impending share buybacks. Build-a-Bear Workshop (BBW) performed admirably in the period, as management continues to leverage its debt-free balance sheet and asset-light international expansion blueprint to generate peer-leading returns on capital and ramping free cash flow, resulting in shareholder returns of ~$123MM since 2021 (~20% of market cap).

Hoegh Autoliners (HAUTO NO) was the top detractor in the period, as declining net freight rates and a disappointing guide from management left investors wondering if peak earnings for the industry are starting to normalize. Shares of Boise Cascade (BCC) fell on disappointing housing trends and resurgent mortgage rates in the period. Chord Energy (CHRD) struggled in the quarter as languishing oil prices led to underperformance versus peers given CHRD’s relatively higher exposure to oil. We still find all three stocks attractive, with Hoegh distributing effectively 100% of its free cash flow to shareholders, or a ~25.4% annualized yield, while Boise Cascade and Chord both have very strong balance sheets and trade at undemanding forward (FY25) EV/EBITDA multiples of ~6.5x and ~3.3x, respectively.

The fund added three new holdings during the quarter. Atkore (ATKR) is a leading manufacturer of electrical infrastructure, poised to benefit from long-term electrification and other “net zero” demand tailwinds, and yet trades at a nearly 50% discount to peers on a forward (FY25) EV/EBITDA basis, while offering strong shareholder returns. Carlyle Group (CG), a former holding in the fund, looks far too cheap, trading at ~11x 2025 earnings, or a roughly 60% discount to alternative asset management peers (TPG, BX, ARES). Semler Scientific (SMLR) is a founder-led Bitcoin proxy, similar to the fund’s MicroStrategy holding, but with a stable medical device business that actually generates cash flow to support ongoing adds to the company’s Bitcoin reserve.

Miller Value Partners Appreciation ETF (MVPA)

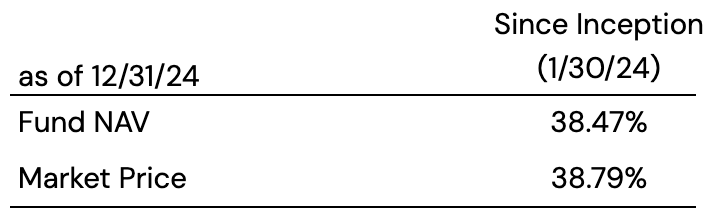

The Miller Value Partners Appreciation (MVPA) fund returned 6.54% (market price) in the fourth quarter, outperforming the S&P 500’s 2.41% gain. For its since inception period, 1/30/24 – 12/31/24, MVPA returned 38.79% versus the S&P 500’s 20.92%.

MicroStrategy (MSTR) and Semler Scientific (SMLR) benefitted from Bitcoin’s rally above $100K in the quarter on political and mainstream adoption tailwinds, while Bread Financial Holdings (BFH) surged on continued rate cuts by the Federal Reserve and moderating late-fee headwinds on the company’s top-line trajectory.

Centene (CNC) was the top detractor in the period as the health insurer continues to navigate an “unprecedented” operating environment, marked by Medicaid membership headwinds and increasing public and political scrutiny in the aftermath of the UnitedHealth CEO’s murder in early December. Shares still trade at a nearly 14% forward (FY25) free cash flow yield, despite an increasingly more visible earnings growth runway and substantial share repurchases. Crocs (CROX) fell on softer-than-expected near-term revenue guidance and disappointing execution from its HEYDUDE brand. The unique shoemaker still generates robust free cash flow and trades at 8.5x 2025 earnings, a roughly 50% discount to its long-term median of ~17x. Similar to Boise Cascade (discussed in Income Fund analysis), Builders FirstSource (BLDR) struggled in the quarter as affordability headwinds continue to plague the housing market, pressuring the building products distributor’s base business and margin profile. We still find BLDR attractive as a long-term compounder, with a renowned history for Mergers & Acquisition (M&A) and shareholder returns, trading at less than 8x 2025 EBITDA.

As portfolio managers, we are relentlessly turning over rocks in the market looking for ideas. But an attractive idea is not considered in a vacuum. MVPA is a concentrated portfolio of our best ideas that, in theory, will produce outperformance over the long term. Some of our ideas will work and some will not. So, when we find a compelling idea, we consider its return/risk profile in the context of the overall portfolio.

We added a plethora of new names in the quarter, including cheap software providers, Expensify (EXFY) and Dropbox (DBX), differentiated digital advertisers with massive addressable markets in Ibotta (IBTA), Pinterest (PINS), Ziff Davis (ZD), and an undervalued life insurer trading at less than tangible book value in Lincoln National (LNC). We also initiated positions in Vroom (VRMMQ)’s stock and convertible bonds, as the former car retailer re-emerges with a prepackaged bankruptcy plan and a consolidated plan focused on its automotive lending business at a discount to Danske Bank (DANSKE DC), after shares approached our internal estimate for intrinsic value. We also eliminated our positions in Match Group (MTCH), Stellantis (STLA), and TotalEnergies SE (TTE).

Miller Value Partners Leverage ETF (MVPL)

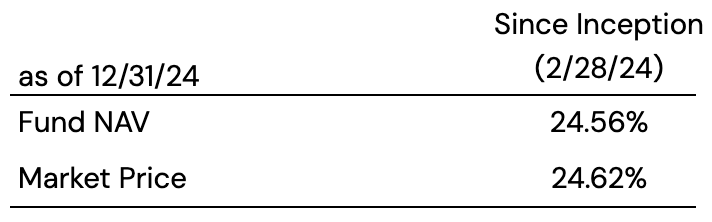

The Miller Value Partners Leverage ETF (MVPL) fund returned 0.50% (market price) in the fourth quarter versus the S&P 500’s 2.41% gain. MVPL launched on 2/27/24 and for its inaugural year as a publicly available ETF, it returned 24.62% versus the S&P 500’s 17.17%.

Since 1988, the S&P 500 Index has delivered positive returns for 86% of rolling 3-year periods, 87% of rolling 5-year periods, and 93% of rolling 10-year periods.2 This tells us: 1. Stay invested in the market, and 2. Leverage can be a useful strategy to outperform if we can manage the position to minimize the downside risk.

And, thus, MVPL’s goal: provide investors the opportunity to capitalize on the propensity of the S&P 500 to go up over time by attempting to improve the risk/return profile of leverage on a systematic basis.

MVPL Principal Investment Strategies: When the Fund is in a leveraged position, the Fund invests in Leveraged ETFs that seek daily leveraged exposure equal to 200% of the S&P 500® Index (the “S&P 500 Index,” or the “Index”). As a result, when the Fund is in a leveraged position, the Fund may be riskier than alternatives that do not use leverage because the objective of the Leveraged ETFs in which the Fund invests is to magnify the daily performance of the Index. When the Fund is in a leveraged position, the return of the Fund for periods longer than a single day will be the result of the Leveraged ETFs’ return for each day compounded over the period. The Fund expects that it will be invested in a Leveraged ETF for periods greater than one day when the Adviser’s trading signals so indicate. As a result, the Fund will be subject to the risks of compounding that affect investments in Leveraged ETFs, and the Fund’s returns during such a period are consequently expected to differ from 200% of the daily return of the Leveraged ETF. For periods longer than a single day, the Fund will lose money if the Underlying ETF’s performance is flat, and it is possible that the Fund will lose money even if the value of the Index rises. This effect can be magnified in volatile markets. Consequently, these investment vehicles may be extremely volatile and can potentially expose the Fund to complete loss of its investment. Longer holding periods, higher volatility of the Index, and leveraged exposure each increase the impact of compounding on an investor’s returns. During periods in which the Index experiences higher volatility, that volatility may affect the Leveraged ETFs’ returns, and the Fund’s return as a result, as much as or more than the return of the Index. Although the Fund, when in a leveraged position, invests in Leveraged ETFs that seek daily leveraged exposure equal to 200% of the Index, the Fund does not target a specific level of leverage over any time period that is more than a single day. Rather, the Fund opportunistically uses leverage in seeking to achieve its objective of capital appreciation over a multi-year horizon. On a daily basis, Investors may check the Fund’s holdings on this website to see whether the Fund is in a leveraged or unleveraged position.