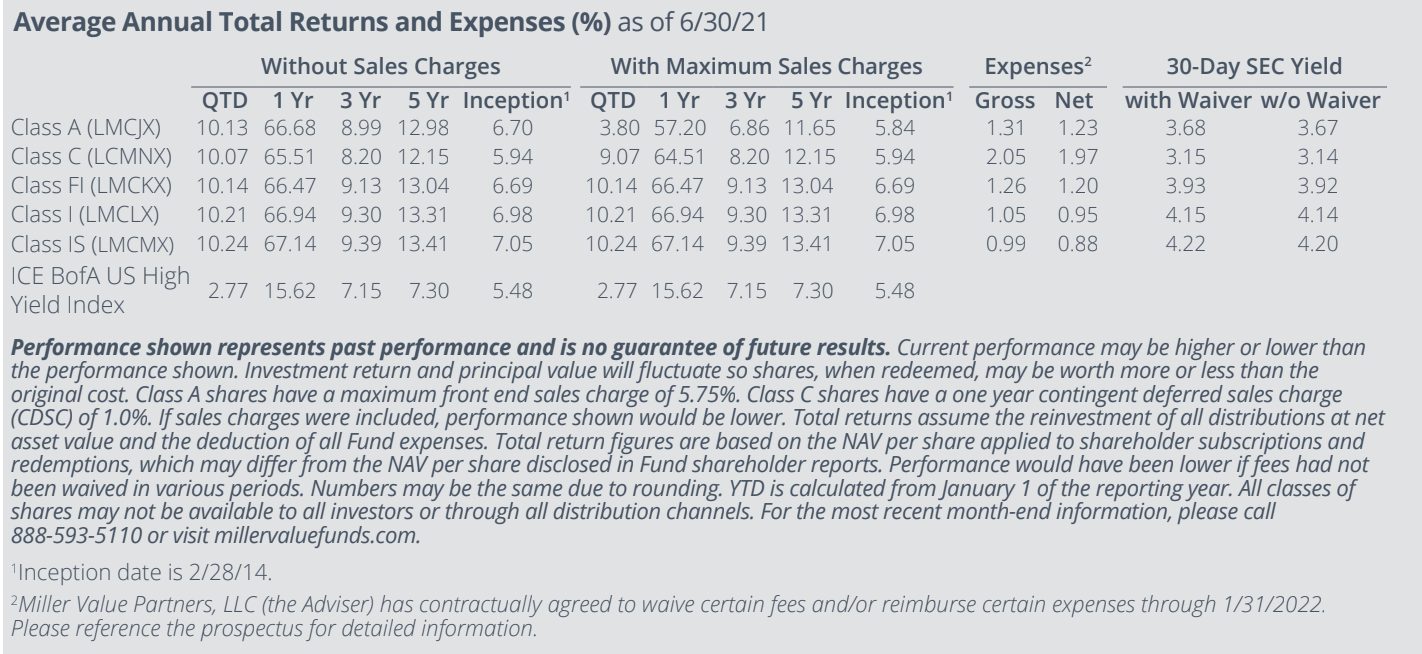

In the second quarter of 2021, the Miller Income Fund’s I-shares returned 10.21% versus 2.77% for the ICE BofA US High Yield Index, as the ongoing economic expansion continued to fuel our performance. We flagged in the last shareholder note that Q1 was the worst quarter for long-dated US government bonds in forty years. Bonds laughed at those comments, as the asset class did an abrupt U-turn; we have yet to see the 10-year yield above the ~1.75% level where it closed the first quarter. Since then, large company stocks have also generally outperformed small company stocks, and faster growing companies have tended to outperform slower growing value names. There is no shortage of potential boogeymen for this dynamic, with new COVID “variants,” geopolitical tensions, and a potential monetary policy error topping the list. However, when we sift through the market’s clues, it seems that simple randomness may be a better answer than any clear cause.

Broadly speaking, the economy is in great shape – GDP is at an all-time high, with exceptional fiscal and monetary stimulus boosting demand and prices against a backdrop of rationalized supply chains. The Federal Open Market Committee appears to now recognize that persistently undershooting its own achievable inflation target leads to capital misallocation across the economy, having changed their stated policy to explicitly allow for inflation overshoots, and the market appears to largely believe them. While the discussion of a taper in light of inflation “surprises” represents a marginally more hawkish shift, the overall stance is still exceptionally accommodative, as the Fed continues catastrophe-level stimulus at a time when there is no longer a catastrophe. All of the liquidity has made many assets very expensive, though we continue to find attractively priced yield as we pick around the pricier and less concentrated baskets.

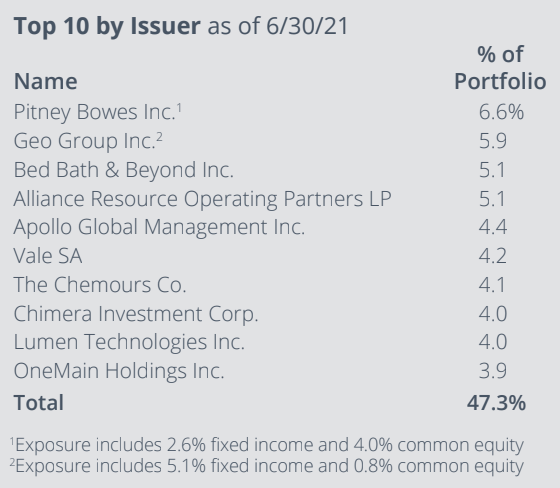

We are constantly on the prowl for yield that we think has a good “skew,” meaning that the security’s price is more likely to go up than down. One of our largest holdings is a new addition and will hopefully demonstrate the concept. Vale is the world’s largest producer of iron ore, and the company has among the highest quality assets. Its high-grade ore helps customers’ blast furnaces run more efficiently, which is especially valuable at a time like the present, when economic activity is pushing high-blast furnace utilization. The company also has an integrated logistics network to ensure a world-class customer experience along with a strong balance sheet. We find the valuation at 2.8x this year’s EBITDA too low (note also that analysts assume iron ore prices are well below spot levels). The market appears to be betting that prices are peaking, which may be the case. However, we think that even if iron ore prices fall back to more normal levels, the stock’s fair value is substantially higher. We believe owners will likely clip a well- covered high-single-digit cash dividend yield each of the next few years, as management simultaneously reinvests to grow the business and buys back shares. If the market also comes around to our view of what the company is worth, we could see some capital appreciation too.

We would much prefer to own something like Vale instead of our benchmark, which yields 3.9% as of this writing, or 150 basis points less than the latest inflation reading of 5.4% from June. Of course, we believe dozens of other securities with attractive valuations also reside in the portfolio. We remain positioned for a growing global economy, and as the largest shareholders of the fund, we are optimistic about the future and welcome any questions or comments.

Top Contributors

- Chico’s FAS (CHS) was the top contributor over the quarter, advancing 98.8% in conjunction with the vaccine rollout accelerating apparel demand and strong Q1 results. Chico’s reported Q1 net sales of $388M, +37% above consensus and +38.4% year-over-year (Y/Y) driven by +65% growth at Soma and a +13.4% rise in digital. Gross margin rose to 32.7% on improved leverage of occupancy costs and leaner inventory driving significantly higher full-price selling. For Fiscal Year 2021 (FY21), management expects consolidated net sales improvement of 28%-34%, gross margin improvement of 18-20 percentage points, and Selling, General & Administrative expense (SG&A) rate improvement of 500-600 basis points (bps). Guidance at the midpoint implies revenue of $1.73Bn and gross margins of 32.9%, +7% and +180bps above consensus, respectively. Additionally, activist shareholder Barrington Capital issued a letter to the company, calling for a Board refresh and expanding the scope of financial disclosure in an attempt to unlock value of the rapidly growing Soma brand.

- Apollo Global Management (APO) rose 33.5% during the period after reporting Q1 distributable earnings of $0.66, topping consensus of $0.57 and the quarterly dividend of $0.50/share (3.3% annualized yield). Fee-related earnings came in at $287M ($0.65/share and a 55.9% margin) while Transaction & Advisory fees of $55.5M beat by $10M. Net accrued performance fees rose 66% quarter-over-quarter (Q/Q) to $1.346Bn, or $3.04/share on strong performance with Private Equity +22%, Credit +3% to +6%, and Real Assets +4%. Total fundraising of $13.4Bn was in-line, driving total assets under management (AUM) to $461Bn and fee-paying AUM to $345Bn.

- The Chemours Co (CC) rose 25.6% during the quarter. The company reported Q1 revenue of $1.436Bn, beating consensus of $1.413Bn and rising +10% Y/Y driven by positive volume contributions across all segments. Earnings Before Income Taxes Depreciation and Amortization (EBITDA) of $268M topped estimates of $265M and rose +4% Y/Y despite a $9M headwind tied to Winter Storm Uri. Better than expected results drove a Free Cash Flow (FCF) improvement of $41M Y/Y to -$21M and cash balance of $1.0Bn. Management raised Fiscal Year 2021 (FY21) guidance, including EBITDA of $1.1Bn-$1.25Bn (from $1.0Bn-$1.15Bn), Earnings Per Share (EPS) of $2.84-$3.56 (from $2.40-$3.12), and FCF greater than $450M (from >$350M). Additionally, peer Orica and private equity firms Littlejohn and One Rock are said to be among groups that submitted bids for the company’s Mining Solutions business. Binding bids are likely to come as soon as this month and are said to value the unit at over $600M (11% of the current market cap and 7% of FY20 revenue and EBITDA). Lastly, Chemours announced a CEO transition with Mark Vergnano moving to non-executive Chairman of the Board and COO Mark Newman becoming CEO effective July 1st. Mr. Newman has been with Chemours since the 2015 split from DuPont (DD), serving as CFO for four years before moving to the COO role in 2019.

Top Detractors

- Home Point Capital (HMPT) was the top detractor over the quarter, falling 36.2% as increased competition and peer price-matching in the wholesale channel pressured the near-term outlook for Gain on Sale margins. Home Point reported Q1 revenue of $422M, well above consensus of $314M driven by a $102M mark-to-market gain on the mortgage servicing rights portfolio. Origination volume of $29Bn topped expectations of $24Bn while Gain on Sale margin dropped 72bps sequentially to 128bps. Management noted higher competitive pressures have further compressed wholesale margins to 78bps in April, though the company expects the move to be temporary with margins normalizing at 115bps in the back half of the year. Management guided to Q2 funded volume of $25Bn-$30Bn, broker partners exceeding 8,000 by year-end (versus 6,000 in Q1), and maintained their commitment to declaring a quarterly dividend of $0.15/share (10.9% annualized yield) in Q2.

- Endo International 6.0% unsecured bond due 2028 declined 17.4% during the period despite reporting strong Q1 results that beat consensus and raising FY21 guidance. Revenue of $718M beat consensus of $688M by 7% and the high-end of the guidance range of $620M-$680M. Gross margin of 72.9% topped guidance of 70.5% while EBITDA of $364.7M came in 21% ahead of analyst expectations of $300.6M. FCF of $227.1M rose +429% Y/Y, driving a cash balance of $1.43Bn and net debt of $6.85Bn, or net leverage of 5.1x. Management raised the low end of FY21 guidance, including revenue to $2.65Bn-$2.79Bn (from $2.55Bn-$2.79Bn), EBITDA to $1.18Bn-$1.28Bn (from $1.12Bn-$1.28Bn), and operating cash flow to $105M-$205M (from $45M-$205M). The credit dropped, however, on concerns of a default liability judgment in Tennessee, ongoing opioid trials in New York and California, and the upcoming Vasostrict trial with Eagle Pharmaceuticals (EGRX).

- MicroStrategy 0.75% convertible bond due 2025 dropped 6.2% over the period. The company reported Q1 revenue of $122.9M (+10% Y/Y), topping consensus by 9.7% driven by subscription service revenue growth of +26%, product license +69%, and subscription billings +19%. Over the quarter, MicroStrategy acquired an additional 13,758 Bitcoins for $529M, the majority of which was funded by the issuance of $500M 6.125% senior secured notes due 2028. As of quarter end, aggregate Bitcoin holdings totaled 105,085 Bitcoins at an aggregate purchase price of $2.741Bn and average purchase price of $26,080, implying an unrealized gain of $894M. Additionally, the company filed a shelf registration with the SEC to sell as much as $1Bn in common stock for general corporate purposes, including the purchase of Bitcoin.