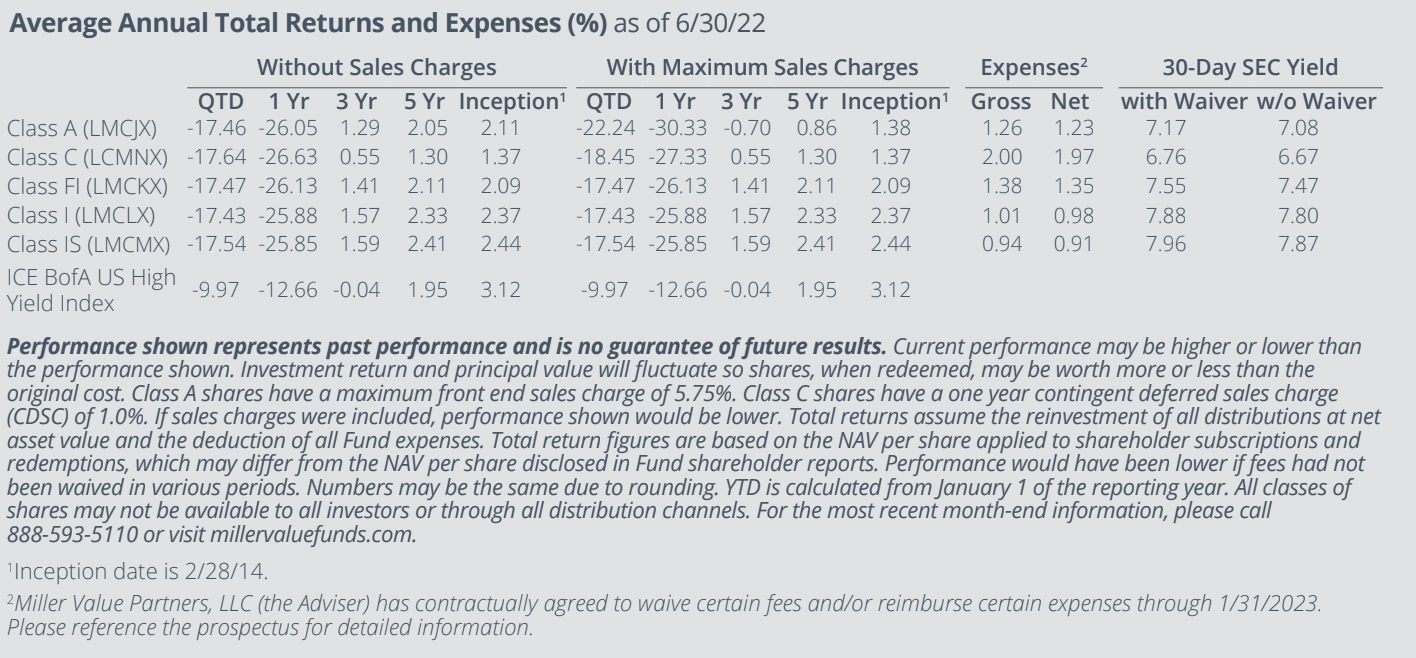

The Miller Income Fund (Class I) lost 17.43% in the second quarter of 2022, underperforming the 9.97% decline for the ICE BofA US High Yield Index. Equities did worse than high-yield bonds, though almost every asset class lost value during the quarter. Markets grappled with how the economy could react to rapidly tightening monetary conditions, with policymakers trying to break the cycle of accelerating price increases. The market’s main concern shifted from rising inflation during the first quarter to recession in the second quarter, thanks to many factors weighing on growth, including lockdowns in China, spiking energy prices, and geopolitical uncertainty.

We touched on this in the last letter, but the extreme swings in the cost of all kinds of things – financing, housing, commodities– are limiting consumers’ and businesses’ ability to plan and transact. At this point, policymakers are laser-focused on reducing the headline inflation rate from its four-decade high. This is understandable, as reported numbers in many ways under-represent the true pain for consumers, especially in the case of large discretionary purchases on credit, such as housing. Over the past six months, the fixed 30-year mortgage rate has gone from 3.27% to 5.83%, while home prices have increased by approximately 10%. This means that the monthly payment a homebuyer can expect on a 30-year fixed mortgage has gone up by around 40% in the past six months. By the time a home shopper is done planning, searching, and ready to make an offer, they need to start looking all over again, because the math no longer works for the budget.

Now, however, the concern has shifted away from inflation to economic slowdown and potentially recession. Financial tightening is happening at a pace not seen in a long time, with the most recent FOMC (Federal Open Market Committee) hike being the largest since 1994. At this point, the Fed Funds target rate has gone up by 150 basis points in span of four months, the shortest amount of time for that level of an increase since the early ‘80s. Dollars leaving the system means not only economic headwinds and layoff announcements, but it also implies that liquidity comes at a premium. Record levels of volatility in the underlying macroeconomic variables are reverberating in the stock market, which is apparent in the underperformance of smaller-capitalization and cyclical stocks. A common shareholder question is, “What are you doing to adjust for this?”

We do not try and predict a highly uncertain macroeconomic future, as there are far too many variables, and the market sniffs out economic troubles and adjusts pricing before any “expert” does. Instead of trying to predict an unforecastable future, we use times of market dislocation to exchange more compelling valuations for more expensive ones. As valuations for perceived certitude have risen across equity markets, prices for compelling businesses with less stable cash flows have come under pressure, presenting an opportunity for long-term investors to shift capital away from winners trading at now- fair prices into some of those names whose embedded expectations look too low. While we cannot say that these stocks have found a bottom, we believe that many of today’s prices represent highly attractive entry points over a multi-year time horizon, assuming we can stomach the volatility and look a few years out. A few examples follow.

Heidelberg Cement (HEI GY) is a new name in the portfolio, and one we expect to hold and potentially build on as market conditions and valuations permit. Operating in over 50 countries with 2,700 locations across five continents, Heidelberg Cement is one of the largest building materials producers in the world and has a $15B enterprise value. The stock is down 40% over the past year, and the share price as of this writing is the lowest on offer in the past decade, outside of the 2020 COVID dip. On valuation, the business now carries a 5% dividend yield and trades at the lowest trailing multiples ever at 0.8x sales and 4x trailing EBITDA (Earnings Before Income, Taxes, Depreciation, and Amortization). Clearly, the market thinks EBITDA is going down over the coming year or two, probably correctly. But the last time this business was available at this valuation was 2003, which also happened to be the last time the Euro traded at parity to the dollar, and it preceded a four-year run where the stock’s annualized return was over four times the market’s. Clearly the next four years will not be the same as that time period, but we believe that if investors can stomach some volatility, we will eventually point to today’s price as a compelling entry point. Perhaps most importantly, there is a high level of alignment between shareholders and management, which owns over a quarter of the company and sees value in the stock. Top shareholder and board member Ludwig Merckle bought €20M ($20.3M) worth of the stock in March at a price higher than today’s, and the company itself has been buying shares on the open market almost every single day this quarter.

Another name with a nice dividend yield, attractive valuation and significant shareholder alignment is clothing retailer The Buckle (BKE). Based in Omaha, NE, management owns almost 40% of the company and is shifting its focus to online sales. The company is very well run and has been onto something for a long time. In each of the last 27 consecutive calendar years, The Buckle has generated positive free cash flow (not “adjusted” free cash flow), something that few companies can say. Despite this track record, the company trades at a trailing free cash flow yield in the teens with a rock-solid balance sheet and a highly aligned management team in Warren Buffett’s backyard.

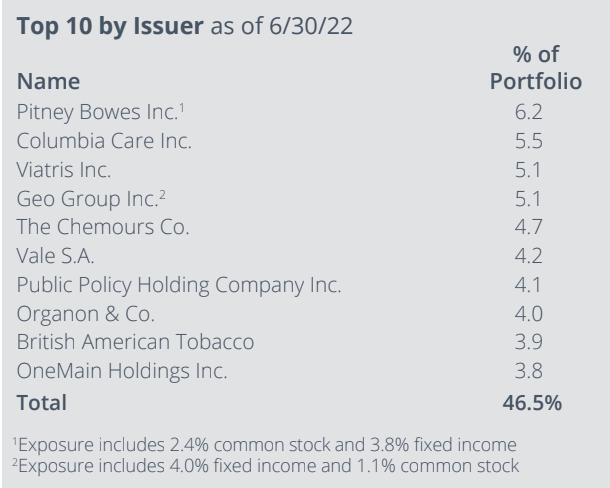

Speaking of stability, the companies in our portfolio with the highest levels of perceived stability have seen their valuations change faster than their fundamental prospects, causing them to approach prices that we now think are closer to fair, especially relative to the aforementioned opportunities. Tax preparation services provider H&R Block (HRB) is up 78% from where it traded in January of this year, while analysts continue to project flat revenues. British American Tobacco (BATS LN) is up 40% from where it traded in December, not because smoking is all the rage in 2022, but because the value of stability has gone up. These types of positions may become funding sources for other things we want to buy at the margin.

We appreciate your support and attention in understanding the thought process behind the Fund’s dynamics. As always, we remain the biggest shareholders in the Fund and welcome any questions or comments.

Top Contributors

- H&R Block (HRB) was the top contributor for the quarter, gaining 36.0%. H&R Block reported 3Q22 revenue of $2.1 billion, +3.9% year-over-year (Y/Y), ahead of consensus of $1.9 billion, and Adjusted Earnings Per Share (EPS) of $4.11, unchanged from 3Q21 EPS, ahead of analyst expectations for EPS of $3.75. The company repurchased 10 million shares for $226 million in the quarter, bringing total fiscal-year 2022 (FY22) share repurchases to $550 million, representing 13% of the company’s shares outstanding. Management also increased its FY22 guidance for revenue of $3.38-3.43 billion, up 3.0% from prior guidance of $3.25-3.35 billion at the midpoint, and EBITDA of $850-875 million (Enterprise Value (EV)/EBITDA of ~8.4x), up 9.2% from prior guidance of $765-815 million at the midpoint. H&R Block’s new mobile banking platform, Spruce, which launched in January, has shown encouraging progress so far, accumulating 150k customer signups and $60 million in customer deposits as of 4/30/22.

- Alliance Resource Partners (ARLP) rose 20.3% in the period. Alliance Resource Partners reported 1Q22 revenue of $460.9 million, +44.7% Y/Y, but down 2.7% from 4Q21, as a result of lower coal sales volume due to previously reported coal shipment delays. The company reported 1Q22 Adjusted EBITDA of $152.3 million, +61.5% Y/Y, and +16.9% from 4Q21, due to higher realized prices for coal and higher oil and gas royalties. The company also raised its 2Q22 cash distribution to $0.35 per unit, implying a 6.7% annualized based on the stock’s 7/13 closing price, and representing a 40% increase from the 1Q22 distribution of $0.25 per unit. Additionally, management now expects to deliver coal for $54-63 per ton in 2022, up 16.7% from January’s estimate of $49.05-51.25 per ton at the midpoint, and to sell as much as 37 million tons this year, compared to previous guidance for as much as 36.7 million tons.

- Home Point Capital Inc (HMPT) advanced 27.4% during the quarter amidst a challenging operating environment, characterized by surging mortgage rates. Home Point reported 1Q22 net revenue of $158.2 million, down from $421.9 million in 1Q21 and $180.5 million in 4Q21, and EPS of $0.09, slightly down from $0.14 in 4Q21, ahead of analyst expectations for a net loss per share of -$0.02. The company reported 1Q22 funded origination volume of $12.6 billion, down from $20.5 billion in 4Q21 and $29.4 billion in 1Q21. During the quarter, the company repurchased 461,690 shares for ~$1.5 million, and currently has $6.5 million of remaining authorized stock repurchases available, representing 1.2% of the company’s market cap. The number of third-party broker partners for the company’s origination segment grew to 8,376 in 1Q22, +4.5% from 8,012 in 4Q21 and +39.1% from 6,023 in 1Q21. Home Point completed sales of mortgage servicing rights portfolios of single-family mortgage loans for a total purchase price of ~$434.5 million in the quarter.

Top Detractors

- Endo International PLC 6.0 6/28 was the top detractor for the quarter, falling 86.5%. Endo reported 1Q22 revenues of $652.3 million, -9.1% Y/Y, ahead of consensus of $631.5 million, and Adjusted EBITDA of $310.9 million, -14.7% Y/Y, exceeding analyst expectations for $264.5 million. Management provided 2Q22 guidance for revenues of $500-525 million, well below consensus of $649 million, and Adjusted EBITDA of $110-125 million, missing analyst expectations for $291 million. The company also announced on 6/30 that it elected to not make an interest payment of approximately $38 million to the 6% Senior Notes due 2028. Following this decision, Endo entered a 30-day grace period to make the interest payment before such non-payment constitutes an event of default. Endo disclosed in a regulatory filing that it plans to continue holding discussions with creditors regarding the company’s strategic alternatives, and that this decision to enter the grace period was not driven by liquidity constraints, as the company held ~$1.4 billion in cash as of 3/31/22.

- Bed Bath & Beyond 5.165% 08/2044 declined 67.4% in the period. Bed Bath & Beyond reported 4Q21 sales of $2.05 billion, down 22% Y/Y, missing consensus of $2.08 billion. The company lost $0.92 per share in the quarter, down from 4Q20 adjusted EPS of $0.40, below analyst expectations for EPS of $0.03. Management noted supply chain disruptions and the Omicron variant led to inventory availability challenges, which had an estimated sales impact of $175 million, or 8.5% of 4Q21 net sales, and a 400 basis points (bps) Y/Y contraction in 4Q21 adjusted gross margin to 28.8%, driven by product cost increases and higher than anticipated freight and shipping costs. Additional headwinds in the quarter included general weakness in the retail segment, highlighted by big earnings misses from Walmart and Target, along with Moody’s downgrading Bed Bath’s corporate family rating from B1 to B2. The ratings agency cited increased execution risk of the company’s strategic turnaround initiatives and ongoing supply chain issues weighing on the company’s market share and profitability going forward as the main drivers for the downgrade. However, Moody’s maintained a stable outlook for the retailer due to the financial flexibility provided by the company’s liquidity position and low level of funded debt.

- Jackson Financial (JXN) fell 37.3% during the quarter. Jackson Financial reported 1Q22 revenue of $4.3 billion, -21.9% Y/Y, and adjusted operating earnings of $3.94 per diluted share, down from earnings of $6.01 per share in 1Q21, below analyst expectations for EPS of $4.72. The market appeared to worry most about a drawdown in risk-based capital, 70% of which came from one-time items or capital return. During the quarter, the company returned $192 million to shareholders through $140 million of share repurchases and $52 million in dividends, in-line with its FY22 capital return target of $425-525 million, or ~22.2% of the company’s market cap at the midpoint.